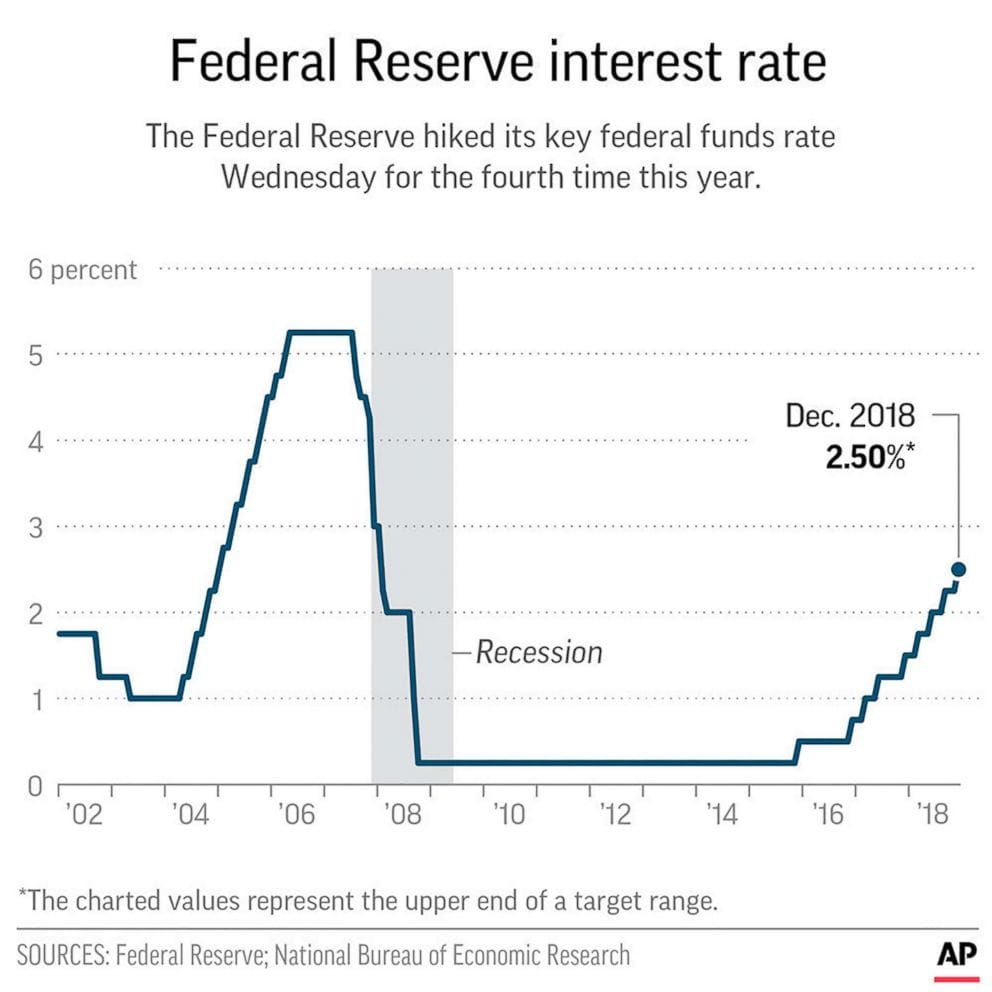

The Federal Reserve, the central bank of the United States, has begun its first interest rate meeting of 2025. The meeting, which runs through Wednesday, will see policymakers assess the current state of the US economy and determine whether to adjust interest rates. The Fed’s decisions on interest rates have a significant impact on borrowing costs for businesses and consumers, as well as on inflation and economic growth.

Tag: US economy

November US Retail Sales: Control Group Data Matches Expectations

The November 2023 US retail sales figures for the control group showed no change compared to the previous month, aligning precisely with market forecasts. This indicates a continuation of the current economic trend, with no significant unexpected shifts in consumer spending. Further analysis is needed to determine the long-term implications of this data.

Stock Market Performance: Analyzing Recent Shifts in the Equities Landscape

Investors and economists have noted a recent flattening of stock futures following the SP 500 and Nasdaq’s retreat from record highs. This article will delve into potential causes for this change, considering various economic and market factors that may affect the equities landscape moving forward.

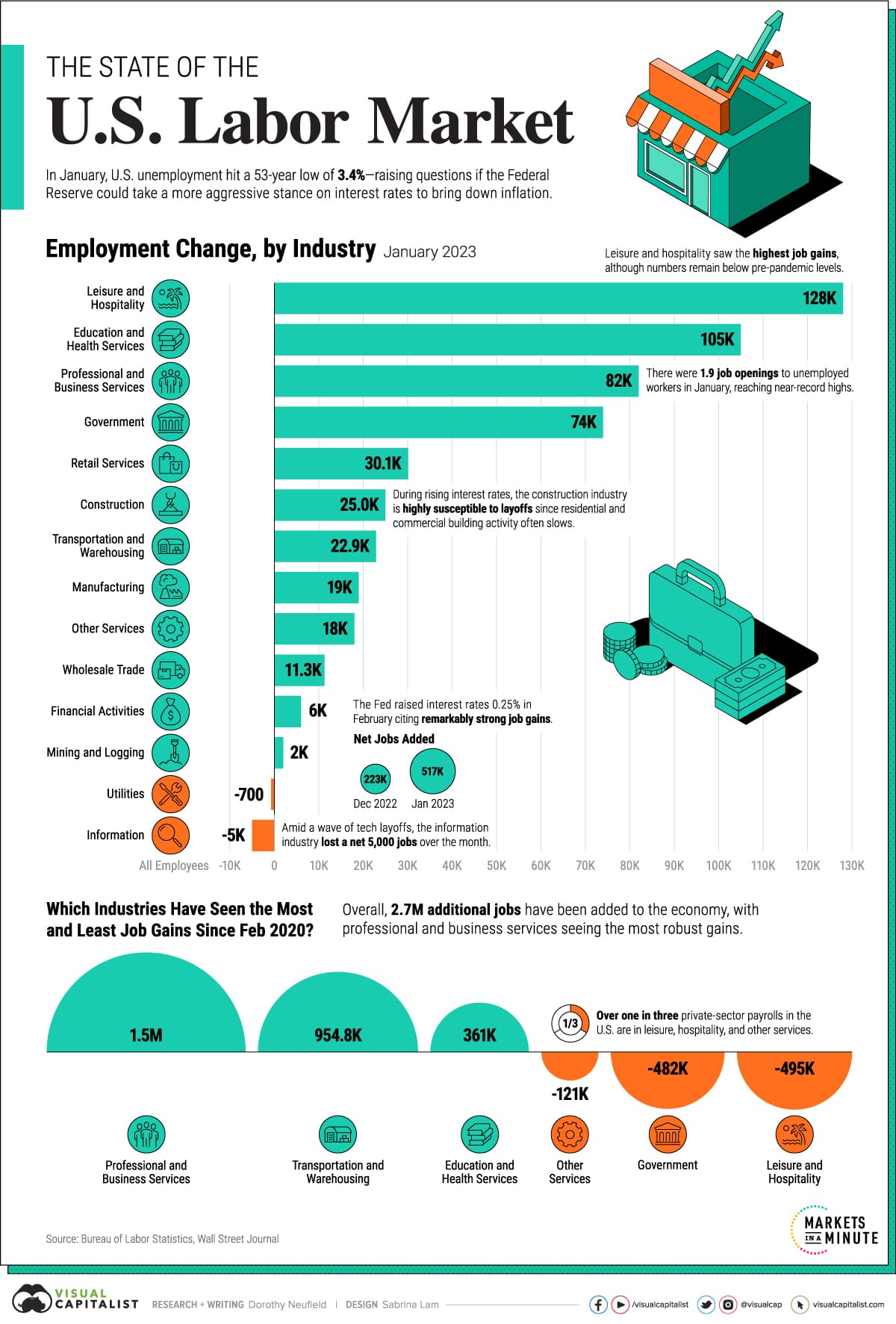

US Labor Market Shows Resilience with 227,000 New Jobs Added in November

The US economy added 227,000 jobs in November, exceeding economists’ expectations and showcasing the labor market’s continued resilience. The unemployment rate remained steady at 4.7%, while average hourly earnings rose by 4 cents.

US Labor Market Sees Strong Job Growth in November

The US economy added 227,000 jobs in November, exceeding economists’ expectations and marking a strong rebound from the previous month’s slowdown. The unemployment rate remained steady at 4.1%, while wage growth showed a modest increase.

Trump’s Economic Legacy Prompts Last-Minute Rate Decisions

The US Federal Reserve is expected to make significant interest rate moves in the final months of the Trump administration, as policymakers respond to the economic uncertainty surrounding the presidential transition. The rate decisions will have far-reaching implications for the economy, financial markets, and consumers.

US Labor Market Reports Strong Job Growth in November, Unemployment Rate Sees Slight Increase

The US labor market experienced a rebound in job growth for the month of November, with a noticeable uptick in the unemployment rate. Despite the positive trend in job creation, the increase in the unemployment rate indicates ongoing challenges in the economy’s recovery.

Jobless Claims Indicate Stability in the US Labor Market Amid Economic Uncertainty

Recent jobless claims data reveals remarkably low layoffs, suggesting resilience in the US economy despite ongoing challenges.