Recent data indicates that the concerns surrounding tariff-induced inflation and potential recession may be exaggerated. Various economic indicators suggest that the impacts of tariffs are being mitigated and that consumer spending remains resilient, challenging prevailing narratives about an impending economic downturn.

Tag: tariffs

Understanding the Implications of US-China Tariff Rollbacks for the American Economy

The recent decision to rollback certain tariffs between the United States and China has sparked significant discussions regarding its potential effects on various sectors of the American economy. This article explores the implications of these tariff changes, focusing on trade dynamics, consumer prices, and domestic industries.

Rising Tariffs: A Looming Challenge for Summer Budgets

As summer approaches, consumers may face significantly higher prices on a variety of goods due to impending tariffs. These tariffs could impact everyday items such as food, clothing, and travel, leading to increased costs for families and businesses alike.

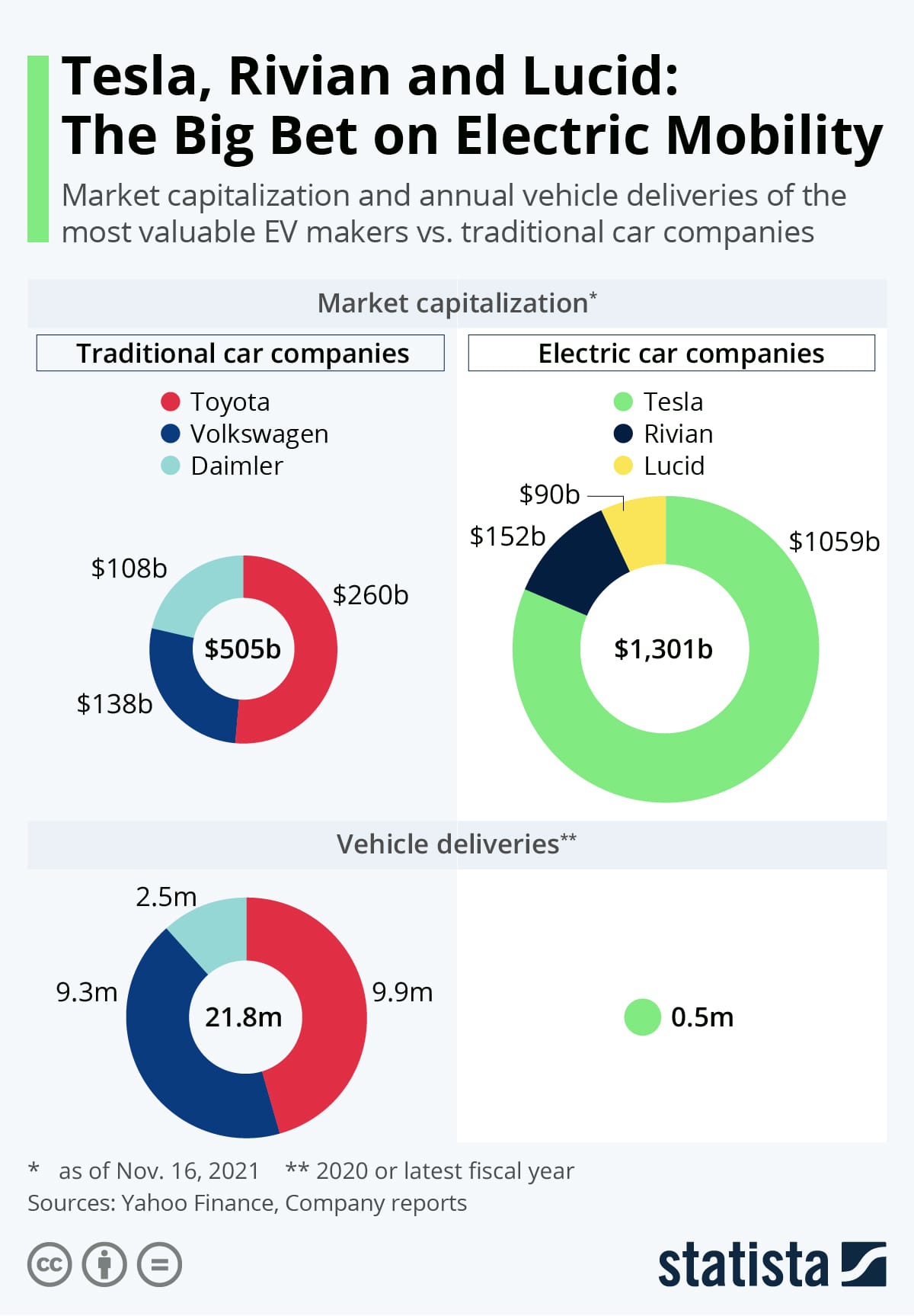

Rivian Adjusts Delivery Projections Amid Tariff Challenges and Trade Tensions

Rivian has revised its delivery guidance due to external economic pressures, particularly tariffs implemented during the Trump administration and ongoing trade conflicts. These factors have contributed to challenges in supply chain management and production costs for the electric vehicle manufacturer.

Challenges Ahead for Stock Rally Following Tariff Policy Reversal

The recent decision by the White House to reconsider its tariff policies has raised concerns about the sustainability of the ongoing stock market rally. Analysts suggest that this change could lead to increased market volatility and impact investor confidence, which might ultimately affect economic growth.

Warren Buffett’s Insight on Trade Tariffs and Their Economic Impact

Warren Buffett recently articulated a strong stance on trade tariffs, emphasizing their implications for both domestic and international markets. His insights provide a critical perspective on the ongoing debates surrounding trade policies and their potential consequences for the global economy.

Apple’s CEO Issues Candid Warning on Tariff Consequences

In a recent statement, Apple’s CEO highlighted the significant challenges posed by tariffs on the tech industry, underscoring potential impacts on prices, innovation, and global supply chains.

US Economic Contraction in Q1 Linked to Rising Imports Pre-Tariff

The US economy contracted in the first quarter, reflecting a 1.4% decline in GDP. This downturn coincided with a surge in imports as businesses rushed to stock up ahead of impending tariffs. The report indicates a shift in trade balances and economic activity concerns, highlighting the complexities in global trade dynamics.

Billionaire Voices Unite Against Trump’s Tariff Policies: Industry Leaders Respond

Prominent billionaires, including Elon Musk, are voicing concerns over the impact of tariffs introduced during the Trump administration. They argue that these policies have miscalculated the complexities of global trade and could hinder business growth, innovation, and consumer prices. This collective response highlights the potential economic ramifications and calls for a reevaluation of trade strategies.

Stock Market Decline: Dow Dropped Over 300 Points Amid Renewed Tariff Concerns

The Dow Jones Industrial Average fell more than 300 points on Tuesday as concerns over renewed tariffs led to a selloff in the stock market. Investors reacted to ongoing trade tensions between the U.S. and its key trading partners, triggering widespread declines across various sectors.