In a significant legislative move, the United States Senate has passed the Social Security Fairness Act, which aims to address and rectify disparities in retirement benefits affecting millions of retirees. The bill, which garnered bipartisan support, seeks to adjust outdated formulas that adversely impact certain groups of beneficiaries, ensuring a more equitable distribution of Social Security benefits.

Tag: Social Security

Significant Updates to Social Security Benefits and Rules Starting January 2025

The Social Security Administration has announced several key changes to its benefits and rules, set to take effect in January 2025. These updates include adjustments to the cost-of-living adjustment (COLA), changes to the earnings subject to Social Security tax, and revisions to the disability determination process. This article will provide a detailed overview of these changes and how they may impact beneficiaries.

Upcoming Social Security Updates: What to Expect in January 2025

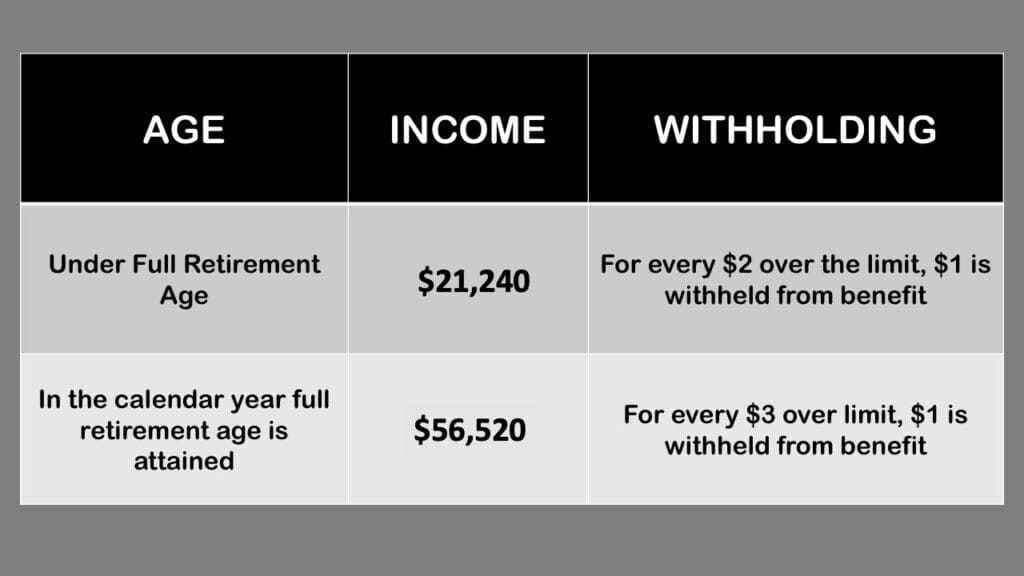

The Social Security Administration has announced several significant changes to take effect in January 2025. These updates aim to improve the overall efficiency and accuracy of the system, while also providing additional support to beneficiaries. Some of the key changes include an increase in the cost-of-living adjustment (COLA), modifications to the tax withholding process, and the implementation of a new online service for recipients.

Changes Coming to Social Security Earnings Credits in 2025

Starting in 2025, the Social Security Administration will be increasing the earnings threshold for Social Security credits, affecting millions of workers. The new amount will be higher than the current $1,730, with the exact figure to be announced later this year.

Update to Social Security Earnings Threshold Announced for 2025

The Social Security Administration has announced a change to the earnings threshold required to earn a single credit of Social Security benefits. Starting in 2025, workers will need to earn a new amount to receive one credit, replacing the current threshold of $1,730. This adjustment aims to reflect changes in the national average wage index and ensure the long-term solvency of the Social Security program.

New Social Security Earnings Threshold to Take Effect in 2025

The Social Security Administration has announced a change to the earnings threshold for Social Security credits, effective January 2025. This adjustment will impact how workers earn credits towards their Social Security benefits. In this article, we will explore the details of the change, how it will affect workers, and what it means for the future of Social Security.

Changes to Social Security Earnings Threshold Set to Take Effect in 2025

The Social Security Administration has announced that the earnings threshold for Social Security credits will increase in 2025, affecting the way workers earn credits towards their future benefits. The change is part of a larger effort to ensure the long-term solvency of the Social Security trust funds.

Changes to Social Security Earnings Threshold to Take Effect in 2025

Starting in 2025, the Social Security Administration will introduce a new earnings threshold for determining Social Security credits. This change will impact how workers earn credits towards their Social Security benefits, with the new threshold replacing the current $1,730 earnings requirement.

Social Security Earnings Threshold to Increase in 2025

Starting in 2025, the earnings threshold for Social Security credits will increase, affecting millions of American workers. The new threshold will be higher than the current $1,730, and will impact how workers earn credits towards their Social Security benefits.

Social Security Earnings Threshold to Increase in 2025: What You Need to Know

Starting in 2025, the Social Security Administration will increase the earnings threshold for Social Security credits from $1,730 to a new amount. This change affects how workers earn credits towards their Social Security benefits. In this article, we’ll explore the details of the change, how it impacts workers, and what it means for the future of Social Security.