Recent fluctuations in tariff policies have led to a significant rise in mortgage rates, impacting borrowing costs for consumers and creating uncertainty in the housing market. This article explores the factors contributing to this surge and its potential implications for homebuyers and the economy.

Tag: Mortgage

US Mortgage Rates Reach Highest Level Since July at 6.91%

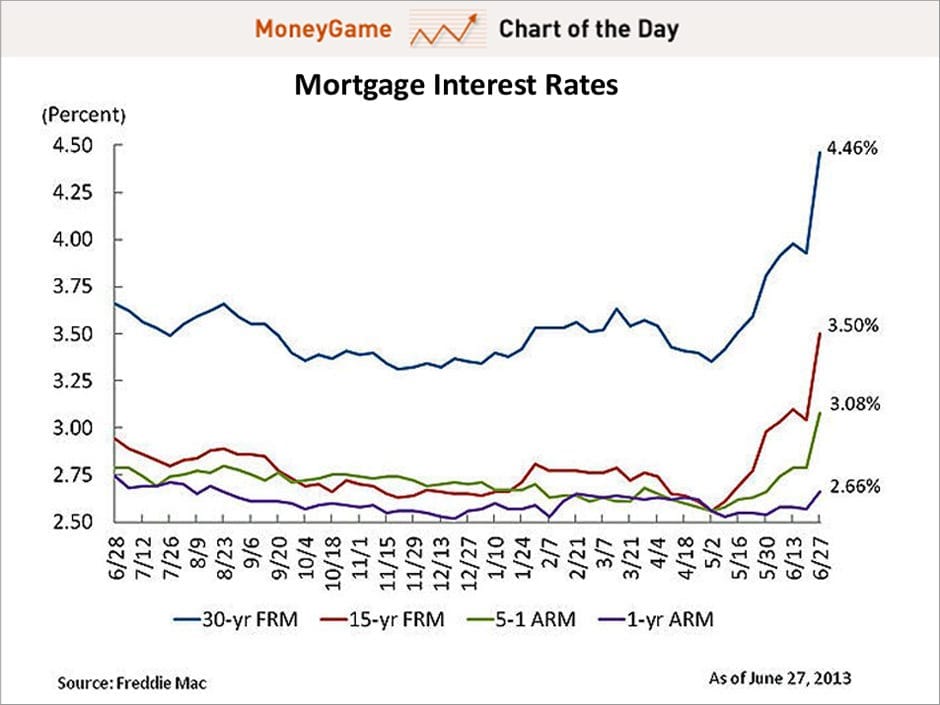

The average rate on a 30-year fixed mortgage in the United States has climbed to 6.91%, according to Freddie Mac, marking the highest level since July. This increase in mortgage rates is indicative of broader trends in the housing market, reflecting shifts in economic conditions and Federal Reserve policies.

US 30-Year Mortgage Rate Reaches 6.91%, Marking Highest Level Since July

The average rate on a 30-year fixed mortgage in the United States has surged to 6.91%, according to Freddie Mac. This figure represents the highest rate observed since July, reflecting ongoing trends in the housing market and broader economic conditions.

Mortgage Rates Surge to Highest Level Since July, Reaching 6.91%

The average rate on a 30-year fixed-rate mortgage in the United States has climbed to 6.91%, according to data released by Freddie Mac. This marks the highest rate seen since July, reflecting ongoing trends in the housing market and broader economic conditions. As mortgage rates continue to rise, potential homebuyers may face increased borrowing costs, which could impact their purchasing decisions.

US Mortgage Rates Reach Highest Level Since July

The average rate on a 30-year fixed mortgage in the United States has surged to 6.91%, according to Freddie Mac. This marks the highest level since July, reflecting ongoing shifts in the housing market and broader economic conditions. The increase in mortgage rates is expected to impact home affordability and buyer sentiment as the housing market continues to adjust.

Surge in 30-Year US Mortgage Rates Reaches 6.91% According to Freddie Mac

The average rate on a 30-year fixed mortgage in the United States has risen to 6.91%, marking the highest level since July, as reported by Freddie Mac. This increase reflects ongoing trends in the housing market and has significant implications for prospective homebuyers and the overall economy.

Mortgage Rates Approach 7% Mark as 2024 Concludes

As 2024 draws to a close, mortgage rates are nearing the 7% threshold, reflecting ongoing economic shifts and influencing both potential homebuyers and the housing market. This trend raises concerns regarding affordability, market activity, and the broader implications for the economy as a whole.

Mortgage Rates Approach 7% Mark as 2024 Draws to a Close

As 2024 comes to an end, mortgage rates are inching closer to the 7% threshold, marking a significant shift in the housing market. This increase is attributed to various economic factors, including inflation rates, Federal Reserve policies, and overall market conditions. Homebuyers and homeowners looking to refinance are facing new challenges as these rates rise, which could impact affordability and housing demand.