Jeffrey Gundlach, prominent bond investor and CEO of DoubleLine Capital, warns of a pivotal moment approaching for U.S. Treasuries, signaling potential volatility in the bond market. He attributes this impending change to various economic factors, including inflationary pressures and shifts in Federal Reserve policy. Gundlach’s insights indicate that investors should prepare for adjustments in their strategies as the landscape evolves.

Tag: inflation

U.S. Inflation Set to Rise Amid Increased Consumer Tariffs

Recent data suggests that U.S. inflation rates may rise as consumers begin to feel the impact of new tariffs imposed on various goods. This shift in economic conditions has implications for purchasing power and consumer behavior, indicating a potential increase in cost of living expenses across different sectors.

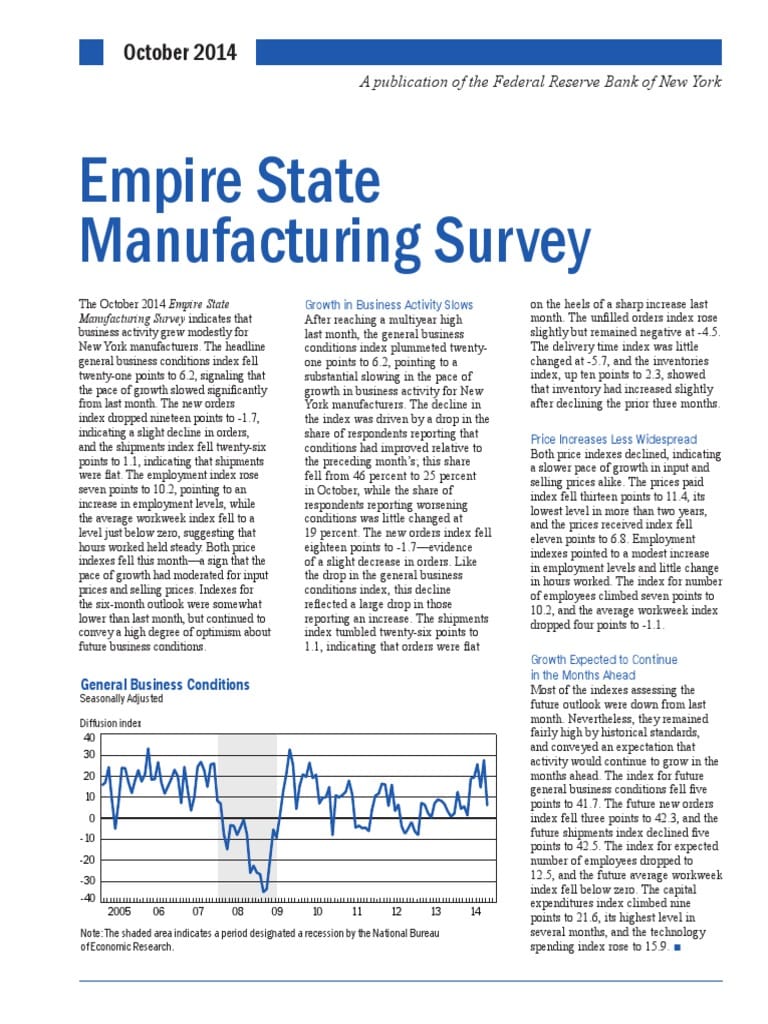

Economic Outlook: Fed Beige Book Reports Decline in Growth and Rising Prices

The latest Federal Reserve Beige Book presents a detailed overview of the U.S. economy, highlighting a notable slowdown in economic growth, increasing prices across various sectors, and sluggish hiring trends. This report aims to assess the prevailing economic conditions through the lens of businesses across the nation, indicating challenges that may impact the recovery process in the coming months.

Reevaluating Tariff-Driven Inflation and Economic Downturn Concerns

Recent data indicates that the concerns surrounding tariff-induced inflation and potential recession may be exaggerated. Various economic indicators suggest that the impacts of tariffs are being mitigated and that consumer spending remains resilient, challenging prevailing narratives about an impending economic downturn.

Rising Tariffs: A Looming Challenge for Summer Budgets

As summer approaches, consumers may face significantly higher prices on a variety of goods due to impending tariffs. These tariffs could impact everyday items such as food, clothing, and travel, leading to increased costs for families and businesses alike.

Wall Street Plummets Amid Tariff and Inflation Concerns

The Dow Jones Industrial Average dropped by 250 points, reflecting heightened fears over tariffs and inflation. The tech-focused Nasdaq also fell 1%, with Amazon recording notable losses. Analysts are closely observing market reactions as inflationary pressures and trade policies loom over investors.

Central Bank Maintains Interest Rates Amid Elevated Inflation Concerns

The Federal Reserve has decided to keep interest rates steady, citing elevated inflation concerns. Chairman Jerome Powell declined to comment on President Trump’s recent statements regarding the Fed’s policies.

Federal Reserve Maintains Interest Rates Amid Inflation Concerns

The Federal Reserve has decided to hold interest rates steady, citing persistent inflation as a key concern. Chairman Jerome Powell refrained from commenting on former President Donald Trump during the press conference following the announcement.

Federal Reserve Maintains Interest Rates Amid Inflation Concerns

The Federal Reserve decided to hold steady the benchmark interest rate, citing ongoing concerns about elevated inflation. During the press conference, Chairman Jerome Powell refrained from commenting on questions regarding former President Trump.

Traders Anticipate US CPI Data and Bank Earnings Reports

As traders prepare for the upcoming release of the US Consumer Price Index (CPI) data and quarterly bank earnings, market participants are adopting a cautious stance. The CPI report is expected to provide insights into inflation trends, while bank earnings will shed light on the financial sector’s health. This combination of economic indicators is likely to influence market movements in the near term.