Data indicates a significant downturn in housing sales throughout 2024, reaching levels not observed since the 1990s. This decrease reflects a substantial shift in market activity, impacting both buyers and sellers and raising questions about broader economic trends.

Tag: Housing

US Mortgage Rates Reach Highest Level Since July at 6.91%

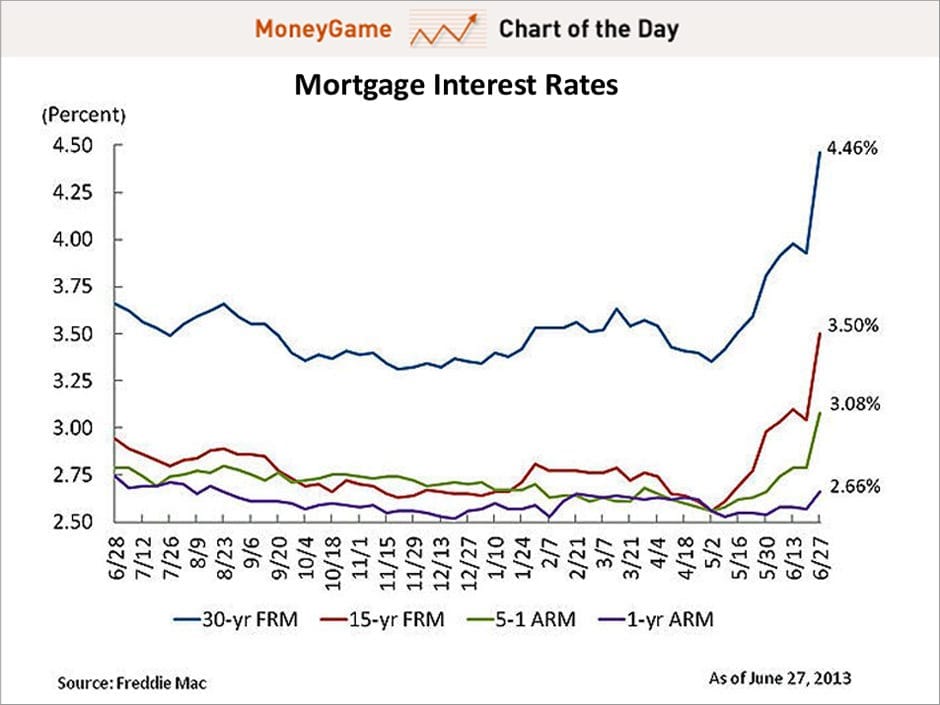

The average rate on a 30-year fixed mortgage in the United States has climbed to 6.91%, according to Freddie Mac, marking the highest level since July. This increase in mortgage rates is indicative of broader trends in the housing market, reflecting shifts in economic conditions and Federal Reserve policies.

US 30-Year Mortgage Rate Reaches 6.91%, Marking Highest Level Since July

The average rate on a 30-year fixed mortgage in the United States has surged to 6.91%, according to Freddie Mac. This figure represents the highest rate observed since July, reflecting ongoing trends in the housing market and broader economic conditions.

Mortgage Rates Surge to Highest Level Since July, Reaching 6.91%

The average rate on a 30-year fixed-rate mortgage in the United States has climbed to 6.91%, according to data released by Freddie Mac. This marks the highest rate seen since July, reflecting ongoing trends in the housing market and broader economic conditions. As mortgage rates continue to rise, potential homebuyers may face increased borrowing costs, which could impact their purchasing decisions.

US Mortgage Rates Reach Highest Level Since July

The average rate on a 30-year fixed mortgage in the United States has surged to 6.91%, according to Freddie Mac. This marks the highest level since July, reflecting ongoing shifts in the housing market and broader economic conditions. The increase in mortgage rates is expected to impact home affordability and buyer sentiment as the housing market continues to adjust.

Mortgage Rates Approach 7% Mark as 2024 Draws to a Close

As 2024 comes to an end, mortgage rates are inching closer to the 7% threshold, marking a significant shift in the housing market. This increase is attributed to various economic factors, including inflation rates, Federal Reserve policies, and overall market conditions. Homebuyers and homeowners looking to refinance are facing new challenges as these rates rise, which could impact affordability and housing demand.

Housing Supply Challenges Loom as Market Approaches 2025

As the housing market transitions into 2025, emerging supply trends signal potential challenges for both buyers and sellers. A combination of factors, including rising construction costs, regulatory hurdles, and demographic shifts, is contributing to a tightening supply that could affect housing affordability and availability in the coming years.

Housing Market Trends Indicate Supply Challenges Ahead of 2025

As the housing market approaches 2025, analysts are expressing concerns over a declining supply trend that could impact affordability and availability. This article explores the factors contributing to the current supply challenges, the potential consequences for buyers and renters, and the broader implications for the economy.

Housing Market Faces Supply Challenges as 2025 Approaches

The housing market is entering 2025 with significant concerns regarding supply shortages. This trend is driven by various factors, including rising construction costs, regulatory hurdles, and shifting demographics. As demand continues to outpace supply, potential implications for affordability and market stability are emerging, prompting discussions among industry stakeholders about possible solutions.

Housing Market Trends Indicate Supply Challenges Ahead for 2025

As the housing market approaches 2025, analysts are raising concerns over a troubling trend in supply levels. With inventory shortages continuing to plague many regions, potential homebuyers may face increasing difficulties in finding affordable options. This article explores the underlying factors contributing to these supply challenges and their implications for the housing market moving forward.