A recent report indicates that the nominee for Treasury Secretary under former President Donald Trump plans to divest from Bitcoin ETF holdings to mitigate any potential conflicts of interest. This decision comes amid growing scrutiny over the intersection of cryptocurrency investments and government positions, highlighting the importance of transparency in financial dealings of public officials.

Tag: cryptocurrency

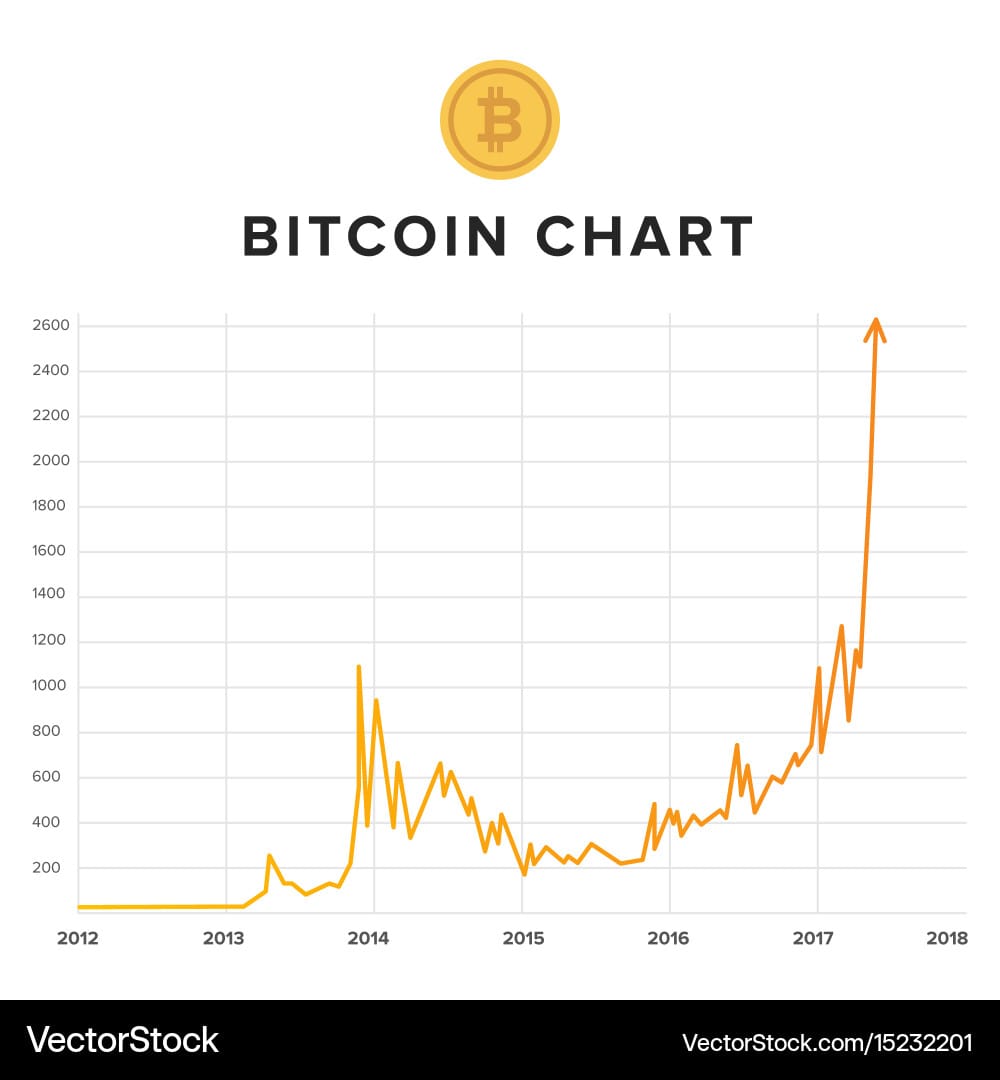

Predictions for Bitcoin Prices in 2025: Doubling to $200,000

As the cryptocurrency market continues to evolve, analysts and experts have made bold predictions regarding Bitcoin’s price trajectory for 2025. Many forecasts suggest that the price of Bitcoin could double to reach $200,000, driven by factors such as increased institutional adoption, regulatory developments, and the overall growth of the digital asset ecosystem. This article explores these predictions, the underlying factors influencing them, and the potential implications for investors and the broader market.

ProXRP Attorney Calls for Urgent Action on ChokePoint 20, Describes Ripple SEC Case as Pivotal

A prominent attorney representing Ripple supporters has called for immediate action regarding the ChokePoint 20 initiative, emphasizing the critical nature of the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The attorney argues that the outcome of this case could have far-reaching implications for the cryptocurrency industry and regulatory landscape.

US Regulators Caution Banks on Cryptocurrency Operations Without Immediate Business Restrictions

Recent documents reveal that U.S. regulators have issued warnings to banks regarding their involvement with cryptocurrency, yet they have not mandated a halt to such business activities. This guidance reflects ongoing concerns about the risks associated with digital assets while allowing financial institutions to continue their operations in the crypto space.

Bitcoin’s Surge: Samson Mow Predicts $1 Million by 2025

In a bold prediction, Bitcoin advocate and entrepreneur Samson Mow has forecasted that the price of Bitcoin could reach $1 million by 2025. This projection has sparked discussions within the cryptocurrency community and among investors, as Mow outlines the factors he believes will drive this significant increase. The implications of such a price point could reshape the financial landscape, prompting both excitement and skepticism.

AI Bitcoin: 2024 Market Impact and Bond Frustration

In 2024, AI Bitcoin’s impact on markets sent waves of disruption. While Bitcoin’s influence brought about significant change, fixed-income investments in the form of bonds led to widespread frustration among investors.

Bitcoin’s Value Relative to Gold Reaches All-Time High Amidst Year-End Market Surge

The ratio of Bitcoin’s price to gold’s price has reached an unprecedented peak, coinciding with a significant increase in Bitcoin’s value during the final months of the year. This surge reflects complex interactions within the cryptocurrency and precious metals markets, prompting analysis of potential contributing factors.

Wall Street Shows Uneven Performance as Bitcoin Reaches New Heights

On a day marked by slight fluctuations in the stock market, Bitcoin has surged to yet another all-time high, captivating investor attention and raising questions about its implications for broader financial markets. As Wall Street grapples with mixed signals, industry experts are analyzing the potential outcomes of this unprecedented climb in cryptocurrency value.

Google Unveils Quantum Chip: Potential Impacts on Cryptocurrency and GPU Markets

Google has recently announced the development of a new quantum chip, sparking discussion about its potential to disrupt the cryptocurrency market, including Bitcoin, and the GPU industry dominated by companies like Nvidia.

The Future of International Financial Stability: Examining the Role of Cryptocurrency Reserves

As countries worldwide consider integrating digital currencies into their financial infrastructure, one question remains at the forefront of discussions—would the establishment of a strategic cryptocurrency reserve truly bring about significant tectonic shifts in our current global financial landscape?