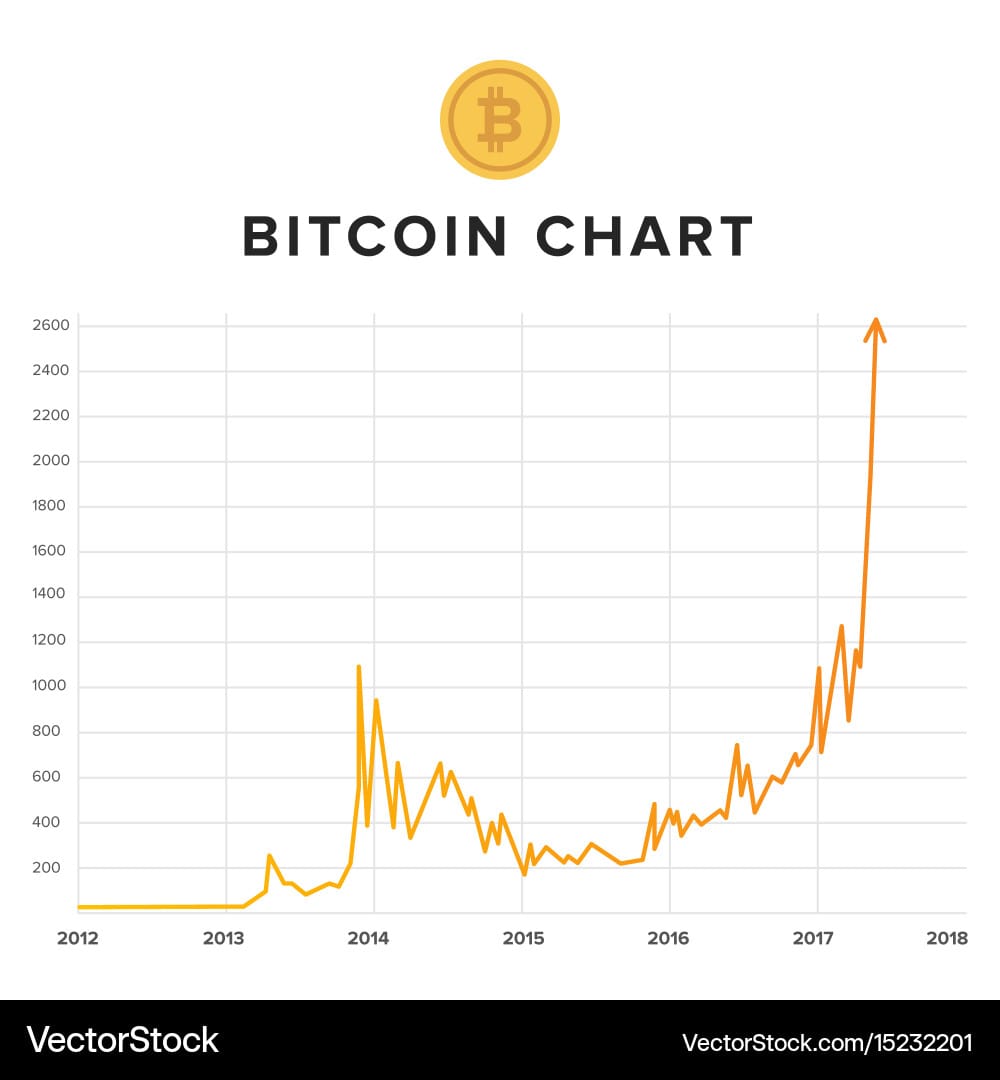

As the cryptocurrency market continues to evolve, analysts and experts have made bold predictions regarding Bitcoin’s price trajectory for 2025. Many forecasts suggest that the price of Bitcoin could double to reach $200,000, driven by factors such as increased institutional adoption, regulatory developments, and the overall growth of the digital asset ecosystem. This article explores these predictions, the underlying factors influencing them, and the potential implications for investors and the broader market.

Tag: Bitcoin

Bitcoin’s Surge: Samson Mow Predicts $1 Million by 2025

In a bold prediction, Bitcoin advocate and entrepreneur Samson Mow has forecasted that the price of Bitcoin could reach $1 million by 2025. This projection has sparked discussions within the cryptocurrency community and among investors, as Mow outlines the factors he believes will drive this significant increase. The implications of such a price point could reshape the financial landscape, prompting both excitement and skepticism.

AI Bitcoin: 2024 Market Impact and Bond Frustration

In 2024, AI Bitcoin’s impact on markets sent waves of disruption. While Bitcoin’s influence brought about significant change, fixed-income investments in the form of bonds led to widespread frustration among investors.

AI-Driven Bitcoin Surge Disrupts Financial Markets in 2024 Amid Bond Market Challenges

In 2024, the financial landscape witnessed a remarkable shift as artificial intelligence (AI) technologies significantly influenced Bitcoin trading, resulting in substantial market volatility. While Bitcoin’s integration with AI attracted considerable investment and speculation, the bond market faced persistent frustrations, marked by rising interest rates and investor uncertainty. This article explores the dynamics of these trends, examining their implications for investors and the broader economy.

Bitcoin’s Value Relative to Gold Reaches All-Time High Amidst Year-End Market Surge

The ratio of Bitcoin’s price to gold’s price has reached an unprecedented peak, coinciding with a significant increase in Bitcoin’s value during the final months of the year. This surge reflects complex interactions within the cryptocurrency and precious metals markets, prompting analysis of potential contributing factors.

Wall Street Shows Uneven Performance as Bitcoin Reaches New Heights

On a day marked by slight fluctuations in the stock market, Bitcoin has surged to yet another all-time high, captivating investor attention and raising questions about its implications for broader financial markets. As Wall Street grapples with mixed signals, industry experts are analyzing the potential outcomes of this unprecedented climb in cryptocurrency value.

US Crypto Reserve’s Impact on Personal Finance Discussed

An in-depth analysis on how the proposed establishment of a US strategic Bitcoin Reserve could potentially impact personal finance and financial markets.

BlackRock’s BTCE Fails as Google Unveils Quantum Chip

BlackRock’s Bitcoin ETF experiences recent downturn amid Google’s quantum computing advancements.Category: TechnologyTags: BlackRock, ETF, Bitcoin, Google, Quantum computing, FinanceSticky: TrueImage: Google quantum chipThe recent trend in BlackRock’s Bitcoin BTC exchange-traded fund (ETF) further declines, as Google unveils a novel quantum computing chip, Willow. Despite the recent downturn, BlackRock’s fund has maintained a positive track record after its introduction in October 2022.Google’s Willow chip is their next-generation quantum processor that promises significant improvements in quantum computing technology. The system optimizes computation speed while devoting fewer resources, amplifying its processing prowess compared to the prior-generation Sycamore processor utilized in 2019. This latest development in quantum computing could both augment and disturb the advancement of industries reliant on processing capabilities.In the present scenario, most standard assets, including Bitcoin, are speculative and face significant market volatility. In addition, traditional banks and financial institutions, like BlackRock, face increasing pressure to adapt their products and services, emphasizing the virtual asset space.Bitcoin’s ETF has seen peaks and troughs since its inception, with BlackRock’s fund contributing significantly to the growth in the industry. Despite recent setbacks, such as global regulatory pressures and the ongoing crypto winter, the fund has remained relatively stable compared to more volatile markets.Google’s entry into quantum computing presents new opportunities and challenges across multiple industries and potentially revolutionizes specific key sectors. These advancements might impact investment institutions, like BlackRock, to further investigate and streamline their integration into their portfolio offerings and financial services.Alternative investment vehicles and financial systems are continuously evolving, making the introduction of quantum computing critical for organizations to remain competitive and adaptive to emerging virtual asset markets. BlackRock’s endeavors in the ETF field, highlighted by the technological progress made by Google, showcase the growing importance of quantum computers in financial services and the opportunities for innovation and risk management.The future of BlackRock’s Bitcoin ETF amid Google’s advancements in quantum computing will rely on the performance and adaptability of BlackRock in the rapidly evolving landscape both within the tech and financial industries. As Google continues to hone their quantum capabilities, it remains to be seen how the evolving technological race will influence not only finance and financial products but also traditional and novel asset classes and market

BlackRock’s Bitcoin ETF Underperforms Amid Exciting Quantum Computing Development

BlackRock’s Bitcoin ETF, representing the largest investment company’s foray into the cryptocurrency market, has experienced a significant dip in performance. The decline in value comes as Google unveils its Bristlecone quantum computing chip, raising questions about how these cutting-edge advancements may impact financial markets in the future.

BlackRock’s Bitcoin ETF Sees Decline Amidst Google’s Quantum Computing Advancements

BlackRock’s Bitcoin Exchange Traded Fund (ETF) experiences a recent drop in value, raising concerns among investors as Google unveils its groundbreaking quantum computing chip, promising significant advancements in the field.