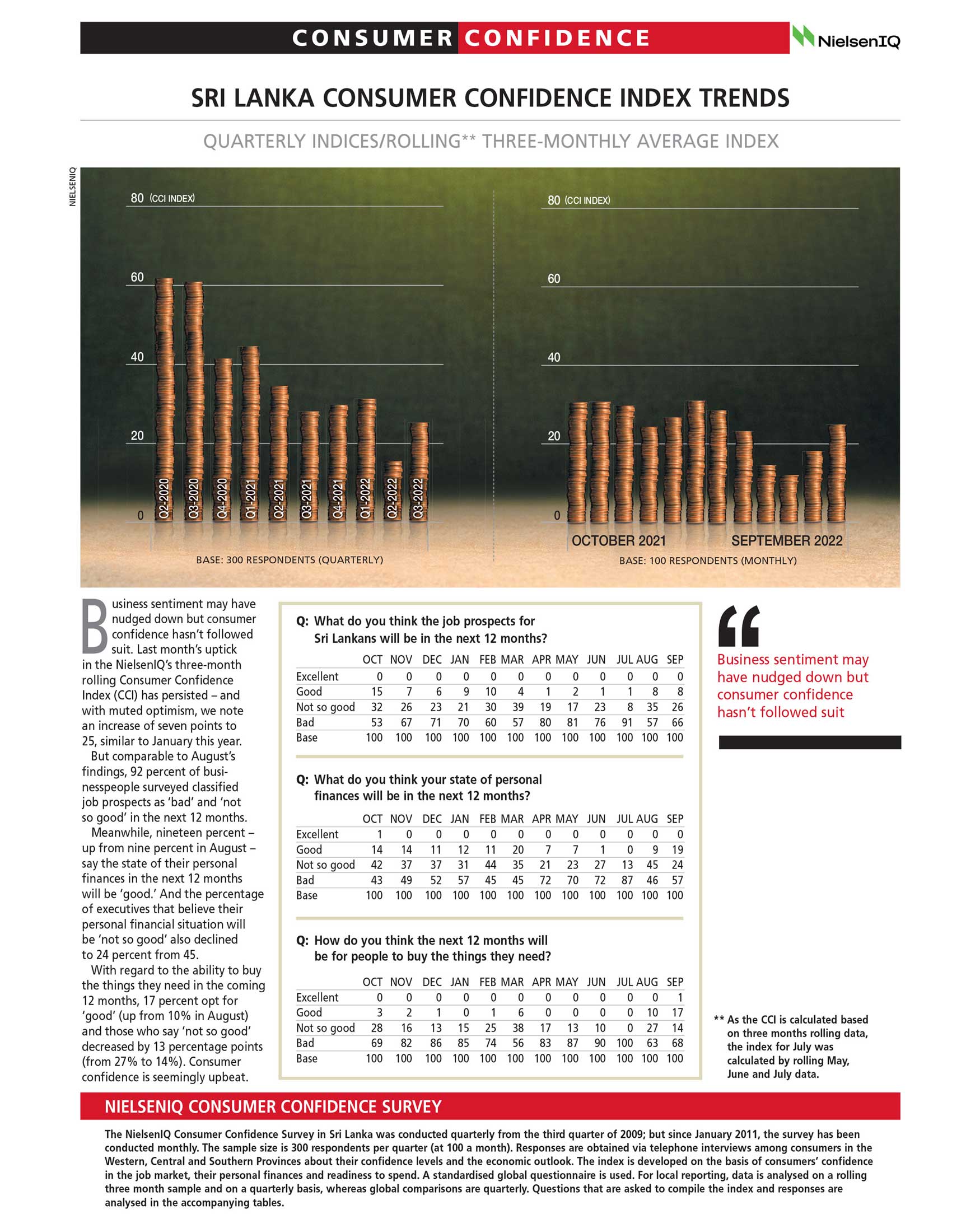

Consumer sentiment has witnessed its first significant uptick since December, indicating a more positive outlook among consumers influenced by various economic factors. This resurgence is pivotal for market dynamics and retail sectors, as it suggests increased confidence in spending and economic conditions moving forward.

Category: Business

Anker Issues Massive Recall of 11 Million Power Banks Due to Fire Risks

Anker has announced a recall affecting over 11 million portable charging devices after multiple reports of fire hazards and other safety concerns from users. The company advises consumers to stop using the affected power banks immediately and provides instructions for returning them.

Trump Proposes Increase in Biofuel Quotas to Limit Foreign Imports

Former President Donald Trump announces plans to enhance national biofuel quotas, aiming to reduce reliance on foreign supply and boost domestic production. This initiative is part of a broader strategy to strengthen the U.S. agricultural economy while addressing energy needs.

Goldman’s Insights on Stock Replacement Options: A Strategic Opportunity

Goldman Sachs has highlighted the current market conditions as favorable for employing the stock replacement options strategy. This article will explore how this strategy works, what it entails, and why it has garnered attention in the investment community.

Market Decline: Dow Drops 400 Points Amid Escalating Tensions with Iran

The Dow Jones Industrial Average plummeted by 400 points following heightened tensions in the Middle East after Israel conducted airstrikes on Iranian positions. The military actions have led to a significant spike in oil prices, reverberating through global markets and creating uncertainty among investors. Live updates suggest continued volatility as geopolitical factors influence economic conditions.

Trump Hints at Potential Interventions on Interest Rates

Former President Donald Trump suggested that he may need to take measures to influence interest rates, emphasizing the economic implications of current policies. His remarks come amid ongoing discussions about inflation and monetary policy, raising questions about the future direction of the economy.

Nvidia Excludes China from Future Forecasts Due to US Export Regulations

In a significant shift, Nvidia’s CEO announced that the company will no longer incorporate China into its financial forecasts, a decision influenced by new US export controls on chip technology. This change underscores the growing impact of geopolitical tensions and regulations on the semiconductor industry.

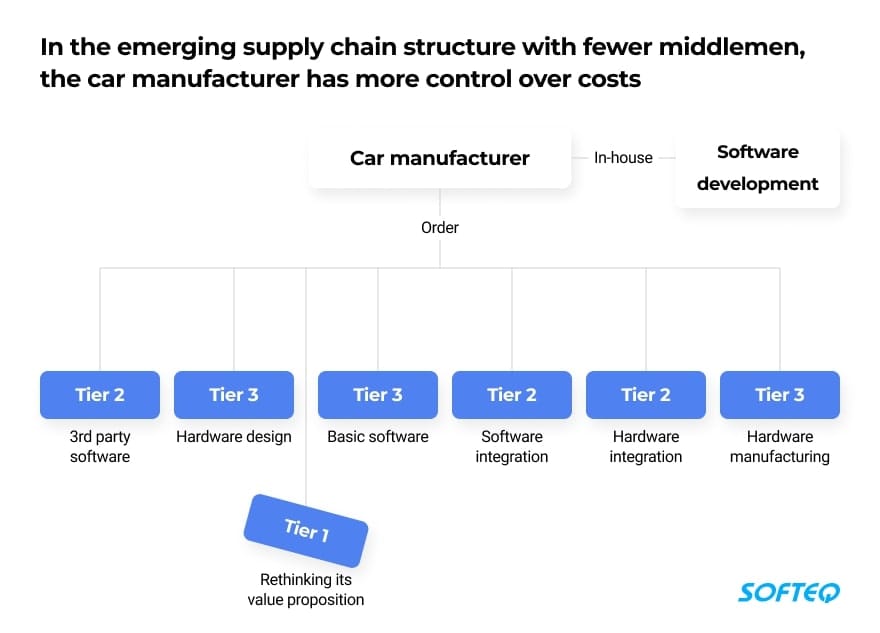

Automotive Supply Chain Faces Bankruptcy Amid Tariff Tensions

The ongoing trade tariff disputes have introduced substantial challenges in the automotive industry, leading to significant financial strains on auto parts manufacturers. Recently, a prominent auto parts supplier filed for bankruptcy, signaling potential ripple effects throughout the supply chain. Industry experts are raising alarms over how these tariffs may reshape the automotive landscape, affecting jobs and pricing for consumers.

Gundlach Predicts Significant Changes Ahead for U.S. Treasury Bonds

Jeffrey Gundlach, prominent bond investor and CEO of DoubleLine Capital, warns of a pivotal moment approaching for U.S. Treasuries, signaling potential volatility in the bond market. He attributes this impending change to various economic factors, including inflationary pressures and shifts in Federal Reserve policy. Gundlach’s insights indicate that investors should prepare for adjustments in their strategies as the landscape evolves.

Nuclear Innovation Soars Following Government Partnership

A nuclear startup has achieved record growth thanks to a significant government deal focused on advancing emerging technologies in the nuclear sector. This landmark partnership aims to enhance energy production and push the boundaries of nuclear innovation, ensuring safer and more efficient operations for the future.