In a day characterized by uncertainty in traditional markets, Bitcoin has once again captured the spotlight by hitting another record high. As the world of finance continues to oscillate between varying trends, many investors and analysts are closely monitoring the implications of this remarkable rise in cryptocurrency.

The stock market opened to a mixed session, with some indices showing slight gains while others encountered minor losses. The Dow Jones Industrial Average reported modest fluctuations, while the S&P 500 saw marginal increases. This divergence among major stock indices could be interpreted as a reflection of investors’ mixed sentiments as they navigate a complex economic landscape that includes inflation concerns and interest rate fluctuations.

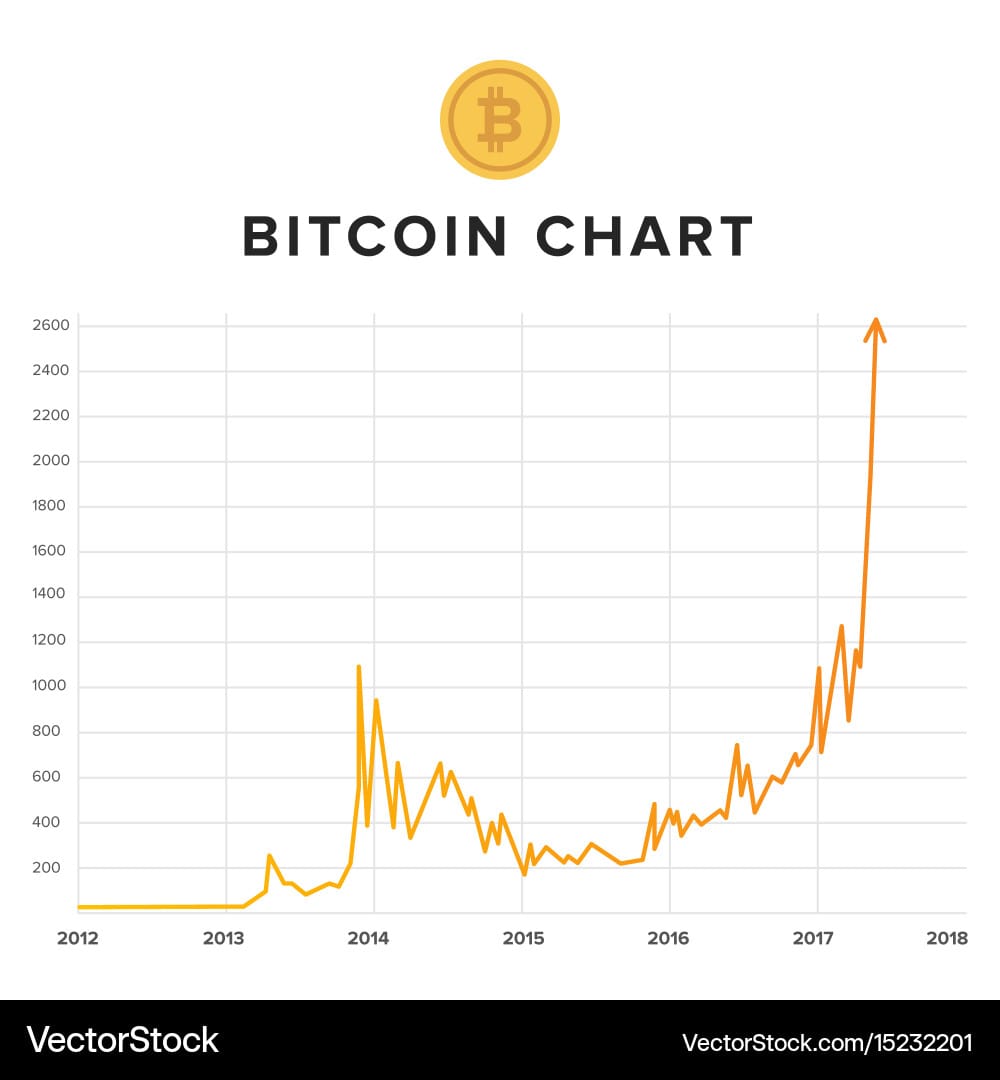

Despite the stock market’s lack of momentum, Bitcoin’s ascent is noteworthy. The cryptocurrency rose above significant psychological barriers, breaking previous records and igniting discussions across financial news platforms. The growing popularity of Bitcoin can be attributed to a range of factors including increasing institutional investments, mainstream adoption, and speculation. These elements contribute to the cryptocurrency’s allure, drawing in a diverse cohort of investors eager to capitalize on Bitcoin’s potential.

One significant aspect influencing Bitcoin’s rise is the expanding acceptance of digital currencies among institutional players. Large financial institutions and corporations have begun to embrace Bitcoin as an asset class, with some adding it to their balance sheets. This trend has been facilitated by increasing advocacy from influential figures in the tech industry, further validating Bitcoin’s place in modern finance. With each endorsement or investment, the perceived legitimacy of Bitcoin as a store of value strengthens, prompting more participants to explore this asset class.

Another factor contributing to Bitcoin’s bullish momentum is increasing retail interest. As more individuals gain access to cryptocurrency trading platforms, the user base continues to expand, fostering a sense of community and shared investment. Social media plays a pivotal role in this phenomenon, with groups dedicated to discussing and promoting cryptocurrencies proliferating across various platforms. Such grassroots efforts contribute to heightened awareness and acceptance of Bitcoin, ultimately driving demand.

Though Bitcoin’s rise may be seen as a sign of financial evolution, it is not without its challenges. Concerns over regulation continue to loom large, as governments worldwide grapple with how to regulate cryptocurrency markets. In several regions, regulatory authorities are intensifying efforts to establish frameworks that ensure investor protection while fostering innovation. These developments could have profound implications on Bitcoin and its market trajectory, prompting investors to remain vigilant.

The relationship between traditional financial markets and cryptocurrency continues to be scrutinized. Bitcoin’s recent rallies have raised questions regarding its correlation with conventional assets like stocks and bonds. Some analysts posit that Bitcoin may serve as a hedge against inflation, particularly in a world where central banks pursue aggressive monetary policies. While traditional markets have been sensitive to economic shifts and geopolitical events, Bitcoin’s price movements often operate independently, suggesting a potential decoupling of these markets.

However, Bitcoin is not immune to volatility. Price corrections often follow rapid ascents, leading to significant surges and plunges that can catch investors off-guard. While its forgiving and dynamic nature has sparked enthusiasm, it also instills a sense of caution. Investors are encouraged to approach Bitcoin with a measured mindset, understanding its propensity for dramatic fluctuations.

The dynamics at play in the cryptocurrency market highlight a broader digital transformation in finance. As Bitcoin and alternative cryptocurrencies gain attentions, traditional financial institutions are increasingly integrating blockchain technology into their operations. This trend indicates a growing recognition of the potential efficiencies that decentralized finance can offer, even as challenges persist.

Amidst Bitcoin’s remarkable ascent, questions surrounding sustainability emerge as well. Critics often cite the environmental impact of Bitcoin mining, which consumes significant energy resources. As awareness regarding climate change intensifies, discussions around the future of Bitcoin and its environmental footprint will likely gain importance, pushing the cryptocurrency community to consider greener alternatives.

In conclusion, the fluctuations in Wall Street juxtaposed against Bitcoin’s relentless ascent present a fascinating study in contrasting market dynamics. While traditional markets face challenges tied to economic uncertainties, Bitcoin continues to captivate attention with its record-setting performances. As the crypto-autonomy landscape evolves, stakeholders await the next developments with heightened curiosity. The ongoing narrative surrounding Bitcoin’s future will undoubtedly shape investor behaviors and the broader financial discourse in the coming months.