The Social Security Administration (SSA) has announced a significant update to the earnings threshold for Social Security credits, which will take effect in 2025. This change affects millions of workers who pay into the system, and it’s essential to understand the implications of this update.

Social Security credits are the building blocks of Social Security benefits. Workers earn credits by working and paying Social Security taxes, and the number of credits earned determines the amount of benefits they receive in retirement or disability. The SSA uses a formula to calculate the number of credits earned based on annual earnings.

Currently, workers earn one credit for every $1,730 in earnings, up to a maximum of four credits per year. However, starting in 2025, the SSA will increase the earnings threshold to $2,320. This means that workers will need to earn at least $2,320 to earn one credit, and the maximum number of credits earned per year will remain at four.

The increase in the earnings threshold is designed to keep pace with inflation and ensure the long-term solvency of the Social Security trust funds. The SSA adjusts the earnings threshold annually to reflect changes in average wages, which have increased significantly over the past few decades.

The impact of this change will vary depending on individual circumstances. For low-income workers, the increase in the earnings threshold may mean that they need to work more hours or earn higher wages to qualify for the same number of credits. On the other hand, high-income workers may not be affected significantly, as they are likely to earn more than the new threshold.

It’s essential to note that this change does not affect the amount of Social Security benefits workers will receive in retirement or disability. The SSA uses a complex formula to calculate benefits based on earnings history, and the increase in the earnings threshold is primarily designed to ensure the solvency of the trust funds.

The SSA has been facing significant challenges in recent years, including a declining trust fund balance and an increasing number of beneficiaries. The 2020 Social Security Trustees Report projected that the trust funds would be depleted by 2035, at which point the SSA would only be able to pay out benefits based on current tax revenues.

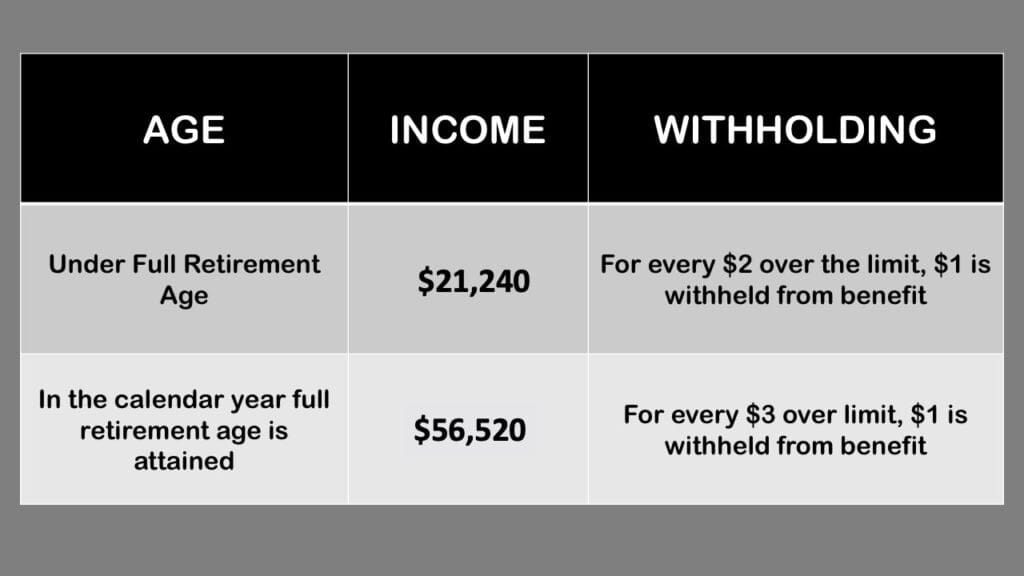

To address these challenges, the SSA has implemented various changes, including the increase in the earnings threshold. Other changes include increases in the full retirement age and adjustments to the benefit formula.

The update to the earnings threshold is a critical step in ensuring the long-term solvency of the Social Security trust funds. While it may require some workers to earn more to qualify for the same number of credits, it’s essential to recognize the importance of this program in providing financial security for millions of Americans.

In conclusion, the update to the Social Security earnings threshold is a significant change that affects millions of workers who pay into the system. While it may have some implications for individual workers, it’s essential to understand the broader context and the importance of this program in ensuring the financial security of Americans.

Timeline of Social Security Changes:

* 1935: Social Security Act signed into law, creating the Social Security program

* 1950s: Social Security expansion, including the addition of disability benefits

* 1972: Automatic cost-of-living adjustments (COLAs) introduced

* 1983: Amendments to the Social Security Act, including increases in the payroll tax rate and the full retirement age

* 1990s: SSA begins to phase in the use of the Consumer Price Index (CPI) to calculate COLAs

* 2010s: SSA implements various changes, including the increase in the full retirement age and adjustments to the benefit formula

* 2020: Social Security Trustees Report projects that the trust funds will be depleted by 2035

* 2025: Update to the Social Security earnings threshold, increasing the amount required to earn one credit from $1,730 to $2,320