The United States government has recently implemented a series of tougher sanctions designed to limit the export of Russian oil to key markets, particularly India and China. This move is part of a comprehensive strategy to exert economic pressure on Russia in light of its continued military operations and geopolitical maneuvers. The sanctions are expected to have significant implications not only for the Russian economy but also for global oil markets and the energy strategies of countries reliant on Russian oil.

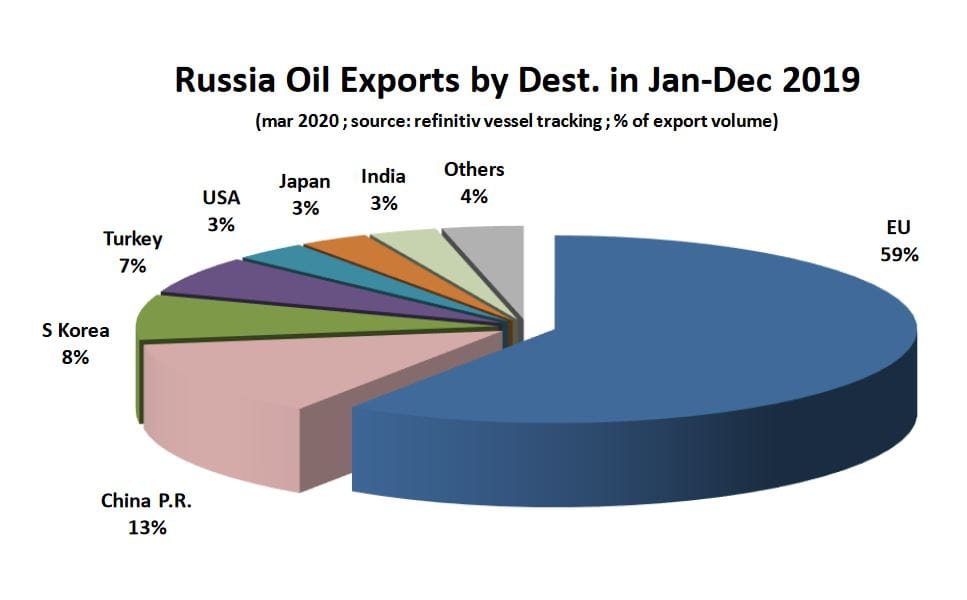

The sanctions come at a time when Russia has been seeking to bolster its oil exports to countries that have not aligned with Western sanctions. India and China, two of the largest consumers of oil in the world, have been significant buyers of Russian crude, especially since the onset of the conflict in Ukraine. The US government has expressed concerns that these purchases are undermining the effectiveness of existing sanctions and providing Russia with much-needed revenue to fund its military activities.

Under the new sanctions, the US aims to target not only the direct sale of Russian oil but also the financial and logistical networks that facilitate these transactions. This includes measures against shipping companies, insurance providers, and financial institutions that engage in or support the transport of Russian oil. The goal is to create a more comprehensive barrier to Russian oil exports, making it increasingly difficult for countries like India and China to continue their purchases without facing repercussions.

The impact of these sanctions is expected to reverberate throughout the global oil market. As countries adjust to the new restrictions, there may be a shift in supply chains and trading patterns. For instance, India and China may seek alternative sources of oil, potentially leading to increased competition for supplies from other oil-producing nations. This could result in price fluctuations and changes in the dynamics of global oil trade.

Moreover, the sanctions may also prompt Russia to explore new partnerships and markets for its oil. In recent months, Russia has been actively seeking to strengthen its ties with countries in the Middle East and Asia, aiming to diversify its customer base and reduce its reliance on Western markets. This pivot could lead to a realignment of global energy relationships, with Russia potentially increasing its oil exports to nations that are willing to overlook the sanctions.

The US sanctions are not without their challenges. Both India and China have expressed their intent to continue purchasing Russian oil, citing their energy security needs and the importance of maintaining stable energy supplies. This presents a complex dilemma for the US, as it seeks to balance its geopolitical objectives with the realities of global energy markets. The effectiveness of the sanctions will largely depend on the willingness of other countries to comply and the ability of the US to enforce these measures.

In addition to the economic implications, the sanctions also carry political weight. They signal a strong stance by the US against Russia’s actions and serve as a warning to other nations that may consider engaging with Russia in the energy sector. The US hopes that by tightening the screws on Russian oil exports, it can not only weaken Russia’s economic position but also rally international support for a unified response to its military aggression.

As the situation continues to evolve, the global community will be closely monitoring the effects of these sanctions. The interplay between energy security, geopolitical strategy, and economic pressure will shape the future of oil markets and international relations. The US sanctions represent a significant escalation in the ongoing efforts to curb Russian influence and hold it accountable for its actions on the world stage.

In conclusion, the tougher US sanctions aimed at curbing Russian oil supply to India and China mark a critical juncture in the ongoing geopolitical landscape. As countries navigate the complexities of energy dependence and international relations, the ramifications of these sanctions will likely be felt for years to come. The global oil market is poised for a period of adjustment, and the long-term effects of these measures will depend on the responses of both Russia and its trading partners.