The financial landscape is currently experiencing a significant shift as the 10-year Treasury yield nears the 5% threshold, a level that has not been seen in recent years. This rise in yield is causing a ripple effect across various sectors of the economy, particularly within the stock market, where investors are expressing heightened concern over the implications of this trend.

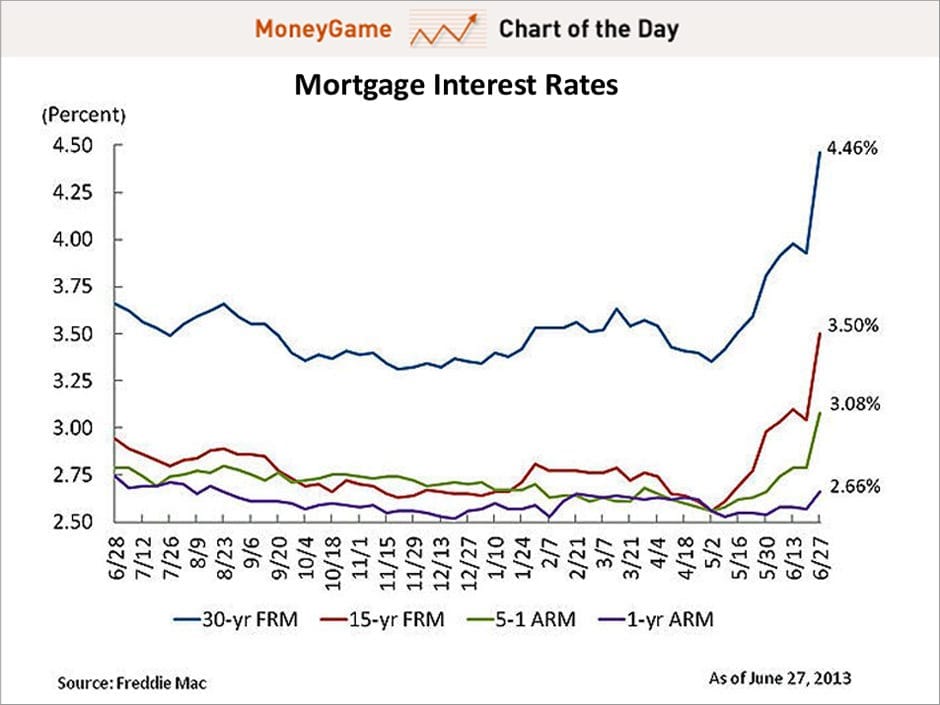

The 10-year Treasury yield is a critical benchmark for various financial instruments, influencing everything from mortgage rates to corporate borrowing costs. When yields rise, it typically indicates that investors are demanding higher returns for holding government debt, often due to expectations of increased inflation or stronger economic growth. In this case, the approach to the 5% mark has raised alarms among stock market participants, who fear that higher yields could lead to a reallocation of capital away from equities and into fixed-income securities.

One of the primary reasons for the surge in the 10-year yield is the Federal Reserve’s monetary policy stance. In recent months, the Fed has signaled its commitment to combating inflation, which has remained stubbornly high. As a result, market participants are anticipating further interest rate hikes, which would contribute to rising yields. The prospect of higher borrowing costs can dampen corporate profits, leading to a reassessment of stock valuations. This has led to increased volatility in the stock market, as investors grapple with the potential for a slowdown in economic growth.

Moreover, the relationship between bond yields and stock prices is often inversely correlated. As yields rise, the attractiveness of bonds increases relative to stocks, prompting some investors to shift their portfolios accordingly. This dynamic can lead to downward pressure on stock prices, particularly in sectors that are sensitive to interest rates, such as technology and real estate. The recent uptick in the 10-year yield has already resulted in notable declines in major stock indices, as investors react to the changing landscape.

In addition to the direct impact on stock prices, the rising yield environment can also affect consumer behavior. Higher interest rates can lead to increased borrowing costs for consumers, which may result in reduced spending. This, in turn, can have a cascading effect on corporate revenues and profitability, further complicating the outlook for the stock market. As consumers tighten their belts, companies may face challenges in meeting growth expectations, leading to a potential slowdown in the broader economy.

The anxiety among stock market investors is palpable, as many are left wondering how to navigate this evolving situation. Some analysts suggest that a diversified investment strategy may be prudent in the face of rising yields. By spreading investments across various asset classes, investors may be better positioned to weather the storm of volatility that often accompanies significant shifts in interest rates.

Furthermore, the global economic context cannot be overlooked. The interconnectedness of financial markets means that developments in one region can have far-reaching implications. For instance, if the U.S. continues to raise interest rates, it could lead to capital outflows from emerging markets, where investors seek higher returns. This could exacerbate financial instability in those regions, creating a feedback loop that impacts global economic growth.

As the 10-year Treasury yield approaches the 5% mark, market participants are closely monitoring economic indicators and central bank communications for clues about the future trajectory of interest rates. The potential for further increases in yields could lead to a more cautious approach among investors, as they reassess their risk tolerance and investment strategies.

In conclusion, the nearing of the 10-year Treasury yield to the 5% level is a significant development that has sparked concerns among stock market investors. The implications of rising yields are multifaceted, affecting everything from corporate profitability to consumer spending. As the financial landscape continues to evolve, investors will need to remain vigilant and adaptable in order to navigate the challenges and opportunities that lie ahead.