The global market stands at a pivotal juncture as anticipation builds for the upcoming discussions between the United States and China. With Tesla’s aggressive strategy to expand its footprint, the outcome of these talks could significantly alter the landscape for electric vehicle (EV) manufacturers worldwide. Tensions have fluctuated between the two economic powerhouses, impacting various sectors, but the automotive industry, given its crucial role in the global economy, is particularly sensitive to potential policy shifts.

As the talks approach, investors, analysts, and industry stakeholders are scrutinizing each pronouncement from both governments. The selection of topics for negotiation includes a host of critical issues ranging from trade tariffs and access to technology, to environmental regulations that could affect the manufacturing and sales of electric vehicles. Given Tesla’s positioning within this context, the stakes are profoundly high for the company’s future growth prospects in China, which is the largest single market for EVs in the world.

Tesla’s expansion strategy is underpinned by a robust commitment to innovation and an unwavering pursuit of market share in the rapidly evolving EV segment. Company executives have hinted at an aggressive growth plan that includes not only increasing production capacity but also enhancing supply chain efficiencies. This strategy is particularly crucial given the fierce competition within the Chinese market, where local brands have gained significant traction and global players are battling to establish their presence.

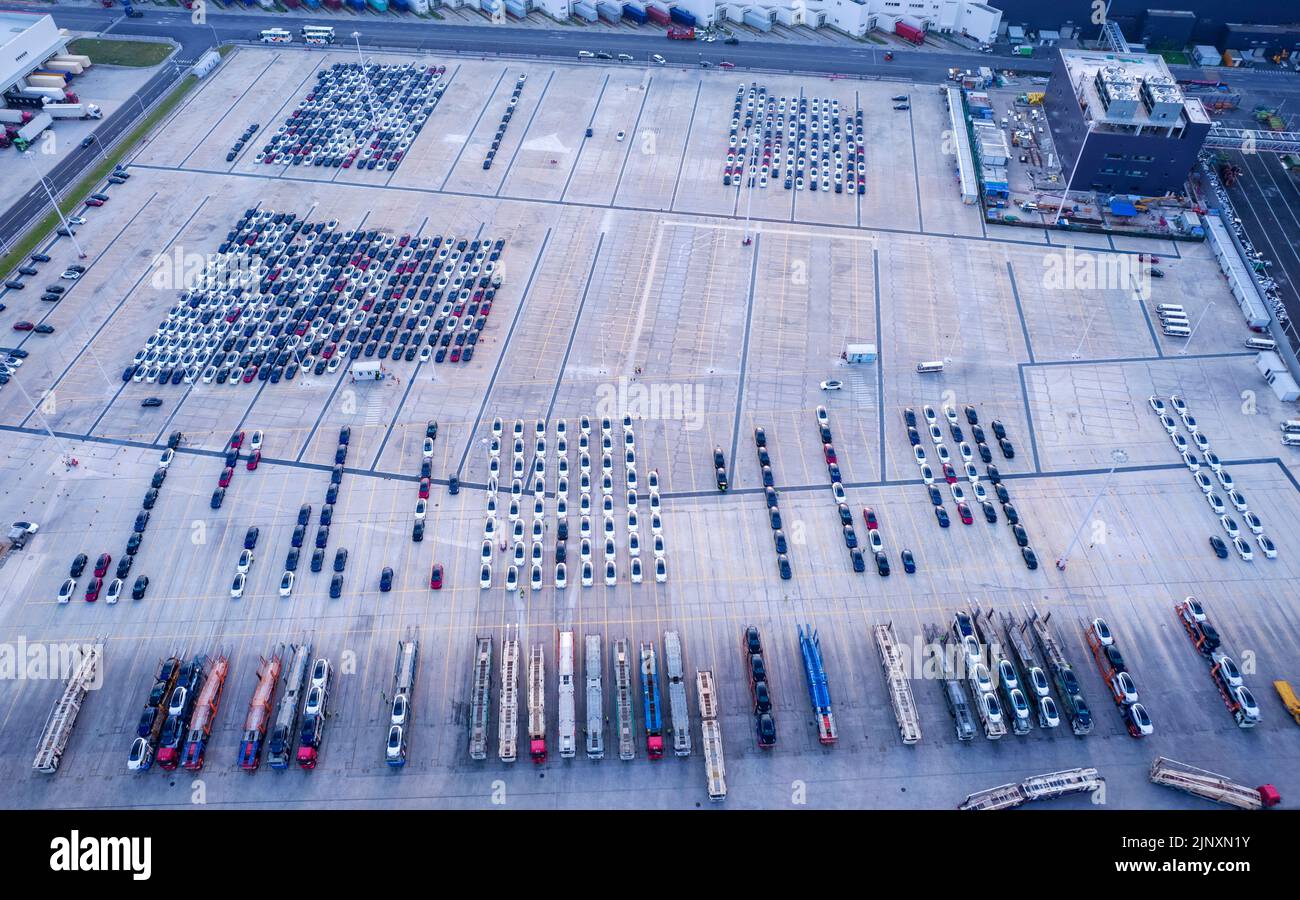

Moreover, Tesla’s Gigafactory in Shanghai continues to play a central role in its operations. This facility has not only allowed for accelerated production but has also positioned Tesla as a key player in the Chinese automotive market. As the discussions between the US and China unfold, the success and functionality of this factory will likely be watched closely since it serves as a litmus test for Tesla’s overall strategy in China and the broader Asia-Pacific region.

The dynamics between the US and China encompass various factors that could either facilitate or hinder Tesla’s aggressive entry strategy. Intellectual property rights, market access, and regulatory frameworks are particular points of contention that may find their way into the negotiations. For instance, discussions around technology transfer and shared responsibilities in the realm of environmental standards may emerge as pivotal topics. How successfully each side navigates these discussions could lay the groundwork for Tesla’s competitive landscape moving forward.

In this context, analysts predict that if the negotiations yield positive outcomes, Tesla’s ability to increase its production and sales in China might experience a significant boost. They anticipate that any reduction in tariffs or easing of restrictions could afford Tesla a clearer path toward scaling its operations, particularly in a market where local demand for EVs is booming. Indeed, this could position Tesla to not only defend its current market share but potentially expand it against both domestic competitors and other multinational automakers seeking to establish themselves in the Chinese market.

Conversely, should the discussions lead to heightened tensions or introduce new barriers to trade, Tesla would have to reassess its strategies. The company has shown resilience in the past, adapting to changing circumstances, but an unfavorable outcome in the talks could recalibrate its growth trajectory and impact its competitiveness.

Financial markets are also reacting to the fluctuations in sentiment surrounding the US-China negotiations. Stock prices of automakers, particularly those focused on the electric vehicle sector, are subject to volatility as new information emerges. Investors are closely monitoring trends in both markets, and significant movements in stock prices could reflect broader sentiments about how talks will unfold and their subsequent implications for market dynamics.

Clearly, Tesla’s workforce and supply chain are continuing to be integral to its performance in this complex geopolitical environment. The synergy between Tesla’s innovative capabilities and the Chinese market presents a powerful combination that could lead to sustained growth, provided that external factors such as international relations remain favorable.

As the world watches, the outcome of the US-China talks will not only affect Tesla but will also set the tone for future international collaborations in the electric vehicle sector. A successful outcome could serve as a model for productive engagement between the two superpowers in other sectors of the economy. Alternatively, a breakdown in cooperation could reinforce a sense of isolationism and protectionism, ultimately reshaping the global economic landscape.

In summary, the impending US-China discussions are critical not just for trade policy but also for the strategic positioning of companies like Tesla. Investors, consumers, and industry experts eagerly await the negotiations, hoping they will result in favorable conditions that promote innovation, competitive pricing, and, ultimately, an essential transition towards sustainable transportation. The world of electric vehicles, with Tesla at the forefront, is keenly observing how this chapter unfolds, emphasizing that the interplay between geopolitics and market strategy has never been more significant.