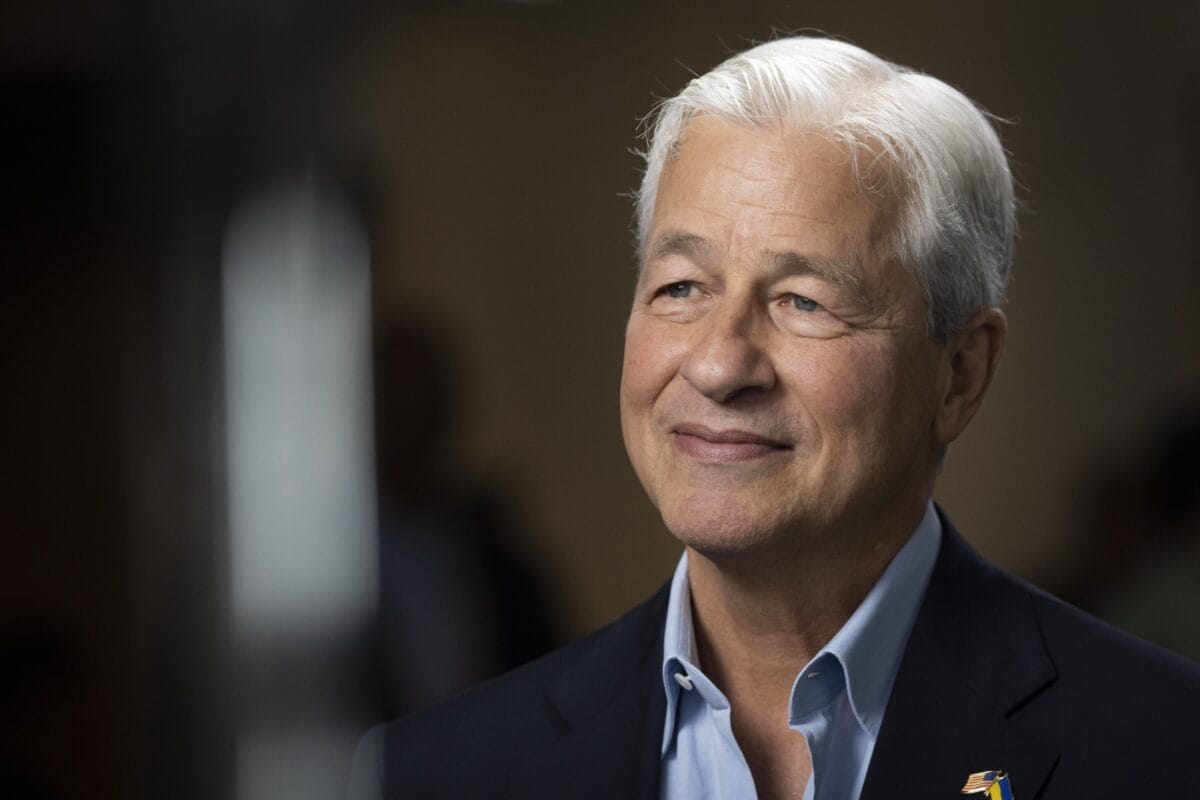

In a recent public appearance, Jamie Dimon, the CEO of JPMorgan Chase, articulated his views on the current financial landscape, emphasizing national security over speculative cryptocurrency investments. During his remarks, Dimon made a stark comparison, suggesting that the United States should focus on building a robust stockpile of missiles as opposed to investing in Bitcoin. His assertion underscores his long-standing skepticism regarding cryptocurrencies, which he perceives as inherently risky and lacking the stability associated with traditional financial instruments.

Dimon’s comments arrive amid a broader context of heightened tensions in global geopolitics, where security concerns have taken center stage. As nations navigate complex relationships, the importance of defense provisions has surged, making Dimon’s emphasis on missile stockpiling particularly resonant. The implication is clear: in an era where military readiness is crucial, investments in tangible assets, such as missiles, are paramount compared to digital currencies that remain highly susceptible to volatility.

Cryptocurrencies, while gaining popularity over the past decade, have also been met with skepticism from various sectors, especially from established financial institutions. Dimon has been vocal about his concerns, reiterating that digital currencies like Bitcoin do not possess the same intrinsic value as traditional financial assets. In his view, the speculative nature of Bitcoin not only poses a risk to individual investors but threatens broader financial stability.

Dimon’s perspective is not isolated; it reflects a growing wariness among financial leaders regarding the cryptocurrency market. The recent fluctuations and downturns in Bitcoin prices have prompted discussions about the role of digital currencies in investment portfolios. Some experts suggest that these assets can provide diversification, while others caution against the inherent risks associated with their volatility.

In a notable contrast, Dimon’s call for increased military preparedness highlights a significant shift in priorities that resonate with policymakers and defense analysts. As nations face evolving threats, the argument for bolstering defense capabilities cannot be dismissed. Dimon’s statement stresses the necessity for the U.S. to prioritize traditional forms of security and defense mechanisms arguably seen as more reliable in times of crisis.

Additionally, the debate surrounding cryptocurrencies often intersects with discussions about regulatory frameworks and government oversight. In light of Dimon’s comments, there may be a renewed call for clearer regulations around cryptocurrencies to protect investors. Such a regulatory approach would aim to mitigate risks while allowing technological innovation to flourish, albeit within a safer environment.

Furthermore, it is important to note that the world of finance is rapidly evolving, with digital currencies and blockchain technologies paving the way for new economic paradigms. However, as leaders like Dimon make their case for prioritizing national security, the long-term implications of such investments remain uncertain. The juxtaposition of traditional defense needs against the backdrop of emerging financial technologies raises questions about the appropriate avenues for government resources.

In the broader scope of economic policy, Dimon’s statement may serve as a catalyst for discussions on how best to approach investments in national security without undermining technological progress. As market dynamics continue to shift, balancing these competing priorities will be essential for future economic stability and security.

The implications of Dimon’s remarks extend beyond the immediate context, challenging the established narrative around cryptocurrencies and their viability as stable investments. Moreover, his emphasis on stockpiling critical defense assets reflects larger societal concerns that prioritize safety and security in an unpredictable world.

Ultimately, Jamie Dimon’s stark comparison between missile stockpiling and cryptocurrency investments is indicative of a larger discourse about the nexus of finance and national security. As economic uncertainty looms and geopolitical threats persist, discussions around where to allocate resources—whether towards military preparedness or emerging financial technologies—will continue to shape public policy and individual investment strategies in the years to come. Dimon’s comments serve as a critical reminder of the significance of reviewing our priorities in a rapidly changing global environment, where security considerations often influence economic decisions. The intersection of financial strategy and national security is a complex landscape that requires careful navigation to ensure both stability and progress.