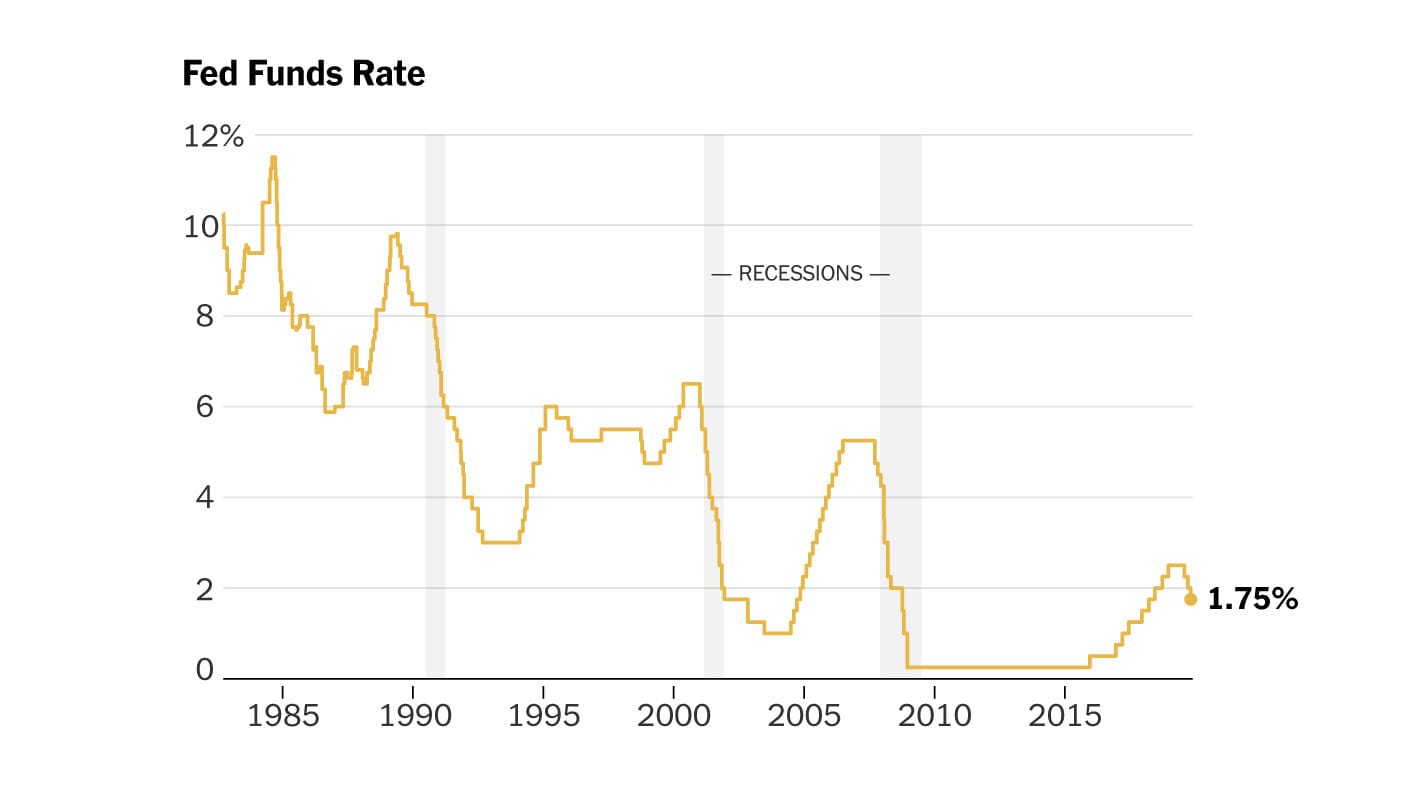

In the latest economic developments, weak jobs data reported by the Bureau of Labor Statistics has sparked vigorous discussions surrounding the necessity of a potential Federal Reserve rate cut. This follows a trend wherein market analysts have been closely monitoring employment figures as a gauge of overall economic health. The disappointing numbers may lead the Federal Reserve to reconsider its current stance on interest rates, especially in the face of ongoing inflationary pressures and slowed economic growth.

The job market, often viewed as a critical indicator of economic vitality, has shown signs of stress in recent reports. Analysts noted that job creation fell short of expectations, with the economy adding fewer jobs than anticipated in the most recent month. A significant factor contributing to this trend has been widespread uncertainty in various sectors, ranging from technology to manufacturing. Such uncertainty may stem from multiple sources including geopolitical tensions, fluctuating consumer demand, and ongoing supply chain disruptions.

As a consequence of the weak job numbers, the prospect of a rate cut is gaining traction among economists and investors alike. A reduction in interest rates could be a strategic move by the Federal Reserve to bolster economic activity by lowering borrowing costs for consumers and businesses. This could encourage spending and investment, potentially aiding in rejuvenating the sluggish job market. However, the decision to cut rates is not without its complexities. Policymakers must consider the broader implications, including potential risks to inflation and market stability.

In parallel with these developments in the job market, Amazon is making headlines with its substantial investments in artificial intelligence technologies. The retail giant has recognized the growing importance of AI in enhancing operational efficiency and customer experience. By significantly bolstering its AI initiatives, Amazon aims to utilize machine learning and data analytics to optimize various aspects of its business, including logistics, customer service, and product recommendations.

This increase in investment comes amidst a competitive landscape where tech companies are rapidly adopting AI solutions to maintain a competitive edge. Amazon’s commitment to AI not only positions the company favorably within the retail sector but also highlights its intent to be a central player in the broader technological landscape. With applications ranging from autonomous delivery systems to advanced data analytics, the potential return on investment in AI could be substantial.

The convergence of weak jobs data and Amazon’s AI investment raises critical questions about the future trajectory of both the economy and the labor market. As the Federal Reserve contemplates its monetary policy adjustments, Amazon’s bold moves in technology may set the stage for new employment opportunities, despite current job market challenges. The AI sector is anticipated to create millions of new jobs over the next decade, necessitating a workforce ready to adapt to emerging technologies.

Moreover, the conversation around economic recovery is evolving. With artificial intelligence poised to transform various industries, the nature of available jobs might shift dramatically. As companies like Amazon invest in advanced technologies, there is an opportunity for supportive training programs that equip workers with the necessary skills to thrive in an AI-driven economy. This transition may ultimately reshape the job market, providing new pathways for employment while addressing the challenges presented by automation.

However, the current economic climate demands a balanced approach. Policymakers must ensure that interest rate adjustments effectively support growth without exacerbating inflation conditions. The relationship between monetary policy, job creation, and sectoral investments such as AI will be critical in navigating the ongoing economic uncertainties. For investors watching these developments closely, the future may present both challenges and opportunities as the landscape evolves.

In conclusion, the interplay between the weak jobs data and Amazon’s investments in AI represents a fascinating intersection of economics and technology. As the Federal Reserve evaluates its options concerning interest rates, the trends driven by corporate investment could help guide economic resilience and innovation. The upcoming months will be crucial for policymakers, businesses, and workers alike as they adapt to a changing economic environment that demands flexibility and foresight.