The most recent trade data from the United States indicates a marked decline in imports, hinting at the early ramifications of the tariff policies instituted by the Trump administration. This downturn raises questions regarding the broader impact on the economy and the future of international trade relationships. As tariffs have been applied to various products, especially from China, businesses and economists are watching closely to understand the cascading effects on the market.

In the months following the initiation of tariffs, statistics reveal a considerable decrease in the volume of goods entering the country. This decline has been attributed to several factors, including increased product prices, reduced availability of certain goods, and ongoing negotiations that have left many importers uncertain about the future. This situation has sparked conversations about the immediate consequences of trade policies that aim to protect domestic industries but may also inadvertently hinder economic fluidity.

As the administration’s tariffs were designed to encourage consumers and businesses to buy American-made products, early signs of import declines suggest that these policies may not be achieving their intended goal. Companies reliant on imported goods for their production processes have reported increased costs, leading to potential price hikes that could affect consumer behavior. Various sectors—including automotive, electronics, and textiles—have expressed concern over how sustained tariffs could disrupt supply chains, which are increasingly global in nature.

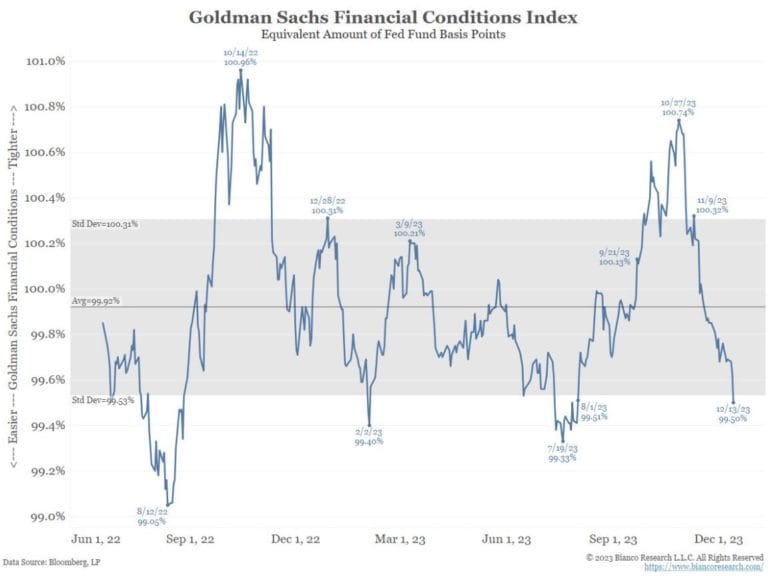

One of the critical points to consider is the immediate impact on prices. Tariffs typically raise the cost of imported goods, which can lead to inflationary pressures in the marketplace. As companies face higher costs for imported materials, many are forced to reconsider pricing strategies or seek alternative sources of supply. This might lead to a short-term reduction in profits for businesses, particularly those competing in price-sensitive markets. As prices increase, consumer purchasing power could also be constrained, further affecting sales and economic growth.

Furthermore, economists have pointed out that the reduced volume of imports may create shortages of certain products. As importers pull back on their purchasing due to tariff implications, consumers may find themselves facing limited options. This situation is particularly troubling in industries that rely heavily on components sourced from abroad. For example, the technology sector, which often depends on specific parts manufactured overseas, could see production delays that ultimately affect product availability in the market.

In light of these developments, trade experts emphasize the need for re-evaluating the current tariff strategies. While protecting domestic industries remains a priority for policymakers, the implications of reduced imports suggest a more nuanced approach may be warranted. Countries are often interlinked in their production processes, meaning that tariffs can lead to retaliation, ultimately creating a cycle of trade barriers that does not benefit either party. Many trading partners have expressed concerns about the longevity of these policies, fearing they may provoke a broader international trade conflict.

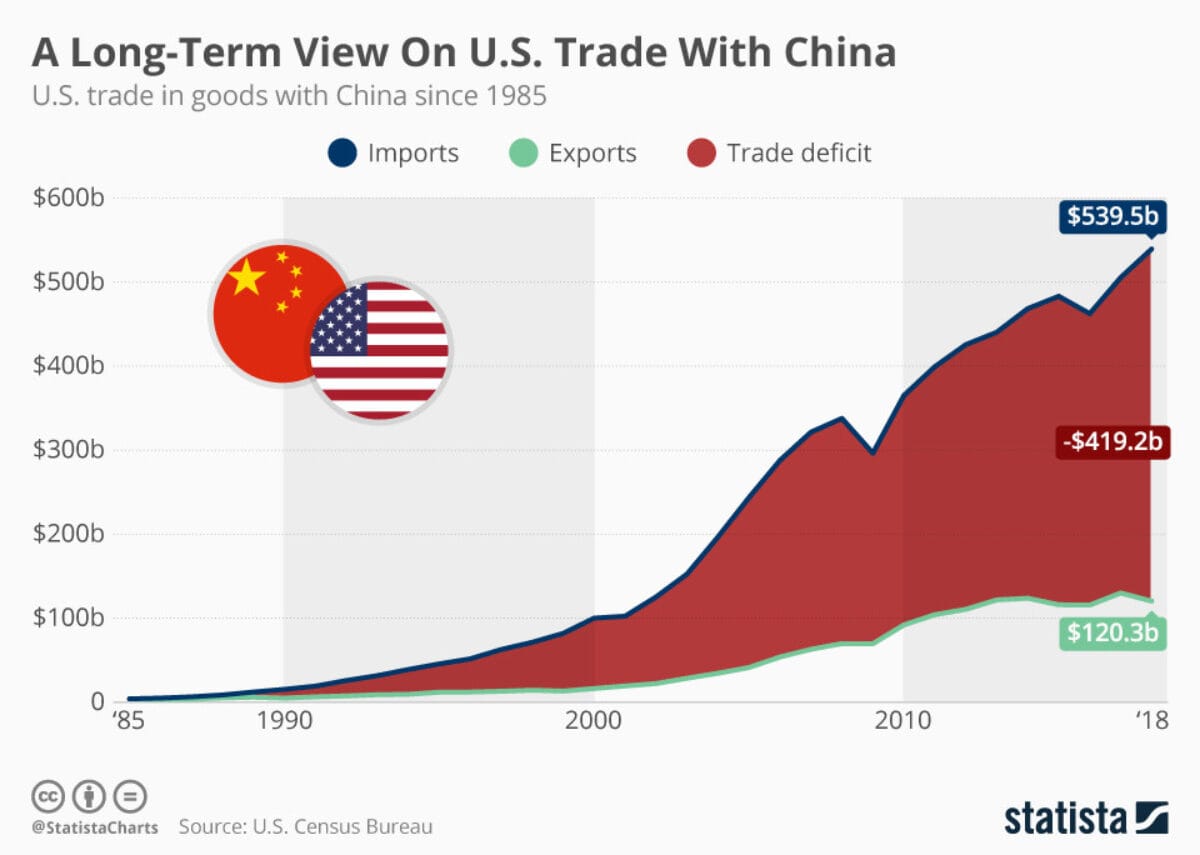

The predicament is further complicated by current geopolitical tensions, where trade policies intersect with diplomatic relationships. The trade war with China, for instance, has escalated into a complex scenario that extends beyond mere economic considerations. The cyclical nature of trade and tariffs suggests that while the intention may be to protect American jobs and industries, the broader implications could lead to unintended consequences that extend into diplomatic and economic relations worldwide.

Moreover, as imports wane, the balance of trade—which measures the difference between exports and imports—may reflect a shifting economic landscape. A decreasing import volume could initially be framed as a sign of domestic growth, but if this trend continues, it may signal deeper problems in the economy. Businesses could face declining market shares as they struggle to meet consumer demands effectively. This aspect underscores the importance of monitoring trade indicators closely in the coming months.

Looking ahead, businesses are urged to assess their supply chains and consider the potential need for diversification to mitigate risks associated with tariffs. Many companies may opt to invest in alternative sourcing strategies, locating suppliers within the U.S. or in countries not affected by tariffs. Such actions could help create a more resilient supply chain, though they may also require substantial time and financial investment. The longer-term implications for U.S. exports also remain uncertain; if foreign markets respond with their tariffs in retaliation, U.S. businesses may encounter obstacles when attempting to compete abroad.

In summation, the recent downturn in imports serves as an early indicator of the potential impact of tariff measures implemented by the Trump administration. As the economic landscape continues to evolve, the repercussions of such policies will require careful scrutiny. Whether the shift in trade patterns will result in sustained changes to the domestic economy remains to be seen, but businesses, economists, and policymakers are advised to approach this scenario with a strategic mindset. While tariffs may protect certain industries temporarily, a balanced assessment of international trade relations is essential to avoid pitfalls and promote economic growth.