Carvana, the online used car retailer that gained significant attention during the pandemic, is now facing increased scrutiny as its stock price slips in the wake of critical remarks from a well-known short-seller. The short-seller has called into question Carvana’s projected turnaround in 2024, describing it as a “mirage.” This statement has sparked discussions among investors and analysts about the company’s future and its ability to overcome the myriad challenges it faces in the current market.

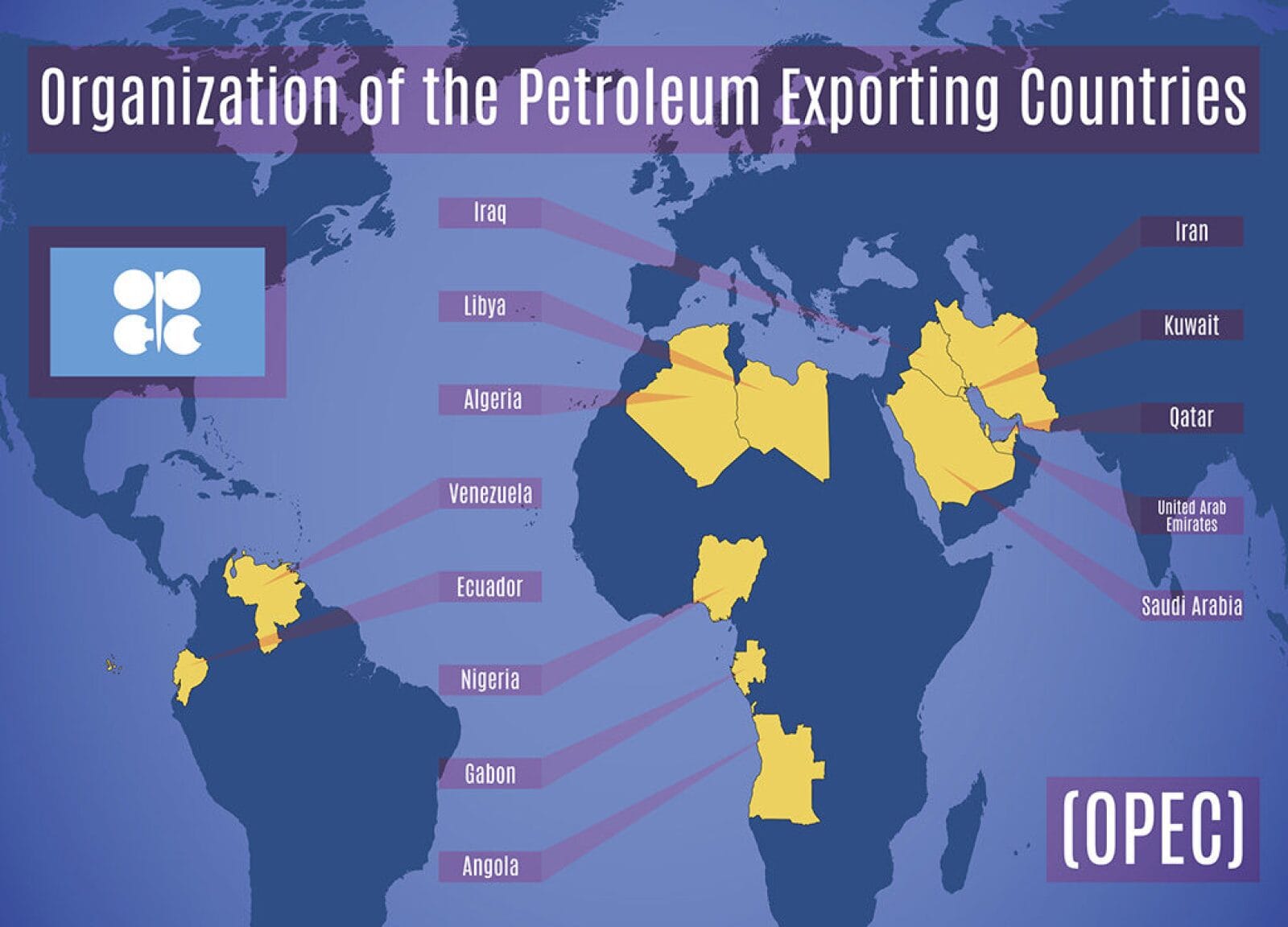

The used car market has experienced considerable fluctuations in recent years, influenced by factors such as supply chain disruptions, rising interest rates, and changing consumer preferences. Carvana, which built its business model on the premise of providing a seamless online car-buying experience, has not been immune to these challenges. As the company attempts to pivot and adapt to the evolving landscape, the skepticism expressed by the short-seller has added to the uncertainty surrounding its recovery plans.

In recent months, Carvana has reported significant financial losses, prompting concerns about its viability as a publicly traded company. The company’s management has outlined a strategy aimed at achieving profitability by 2024, which includes reducing costs, improving operational efficiency, and enhancing customer experience. However, the short-seller’s remarks suggest that these efforts may not be sufficient to turn the tide for Carvana.

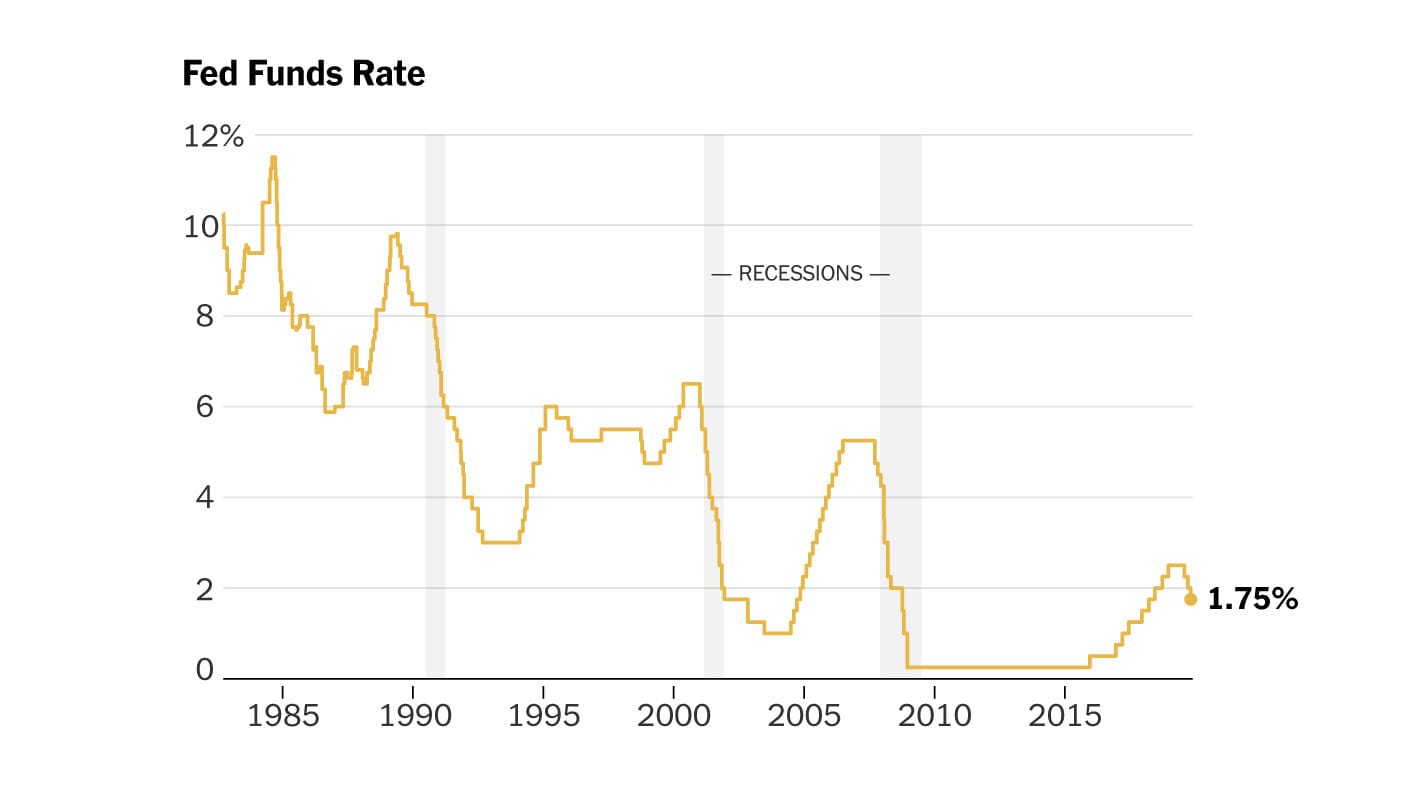

Investors are particularly wary of the company’s high debt levels, which have been a point of contention among analysts. Carvana’s aggressive expansion strategy in previous years has resulted in substantial borrowing, and as interest rates continue to rise, the cost of servicing this debt could become a significant burden. The short-seller’s assertion that the company’s turnaround is a “mirage” resonates with those who believe that Carvana may not be able to generate the necessary cash flow to meet its obligations.

Furthermore, the competitive landscape in the used car market has intensified, with traditional dealerships and new entrants vying for market share. Carvana’s unique selling proposition of offering a fully online purchasing experience has been challenged by competitors who have adapted to the digital shift. As consumers become more discerning and price-sensitive, Carvana may find it increasingly difficult to attract and retain customers.

Despite these challenges, Carvana’s management remains optimistic about the company’s future. They have emphasized their commitment to innovation and customer satisfaction, citing improvements in their logistics and delivery processes as key components of their turnaround strategy. However, the skepticism from the short-seller and other market observers raises questions about the feasibility of these plans.

In response to the short-seller’s claims, Carvana has reiterated its belief in the strength of its business model and the potential for recovery. The company is focusing on enhancing its inventory management and expanding its service offerings to better meet customer needs. As the used car market continues to evolve, Carvana’s ability to adapt and respond to changing consumer preferences will be crucial to its success.

The broader economic environment also plays a significant role in Carvana’s prospects. Factors such as inflation, interest rates, and consumer spending patterns will undoubtedly impact the used car market. If economic conditions remain unfavorable, Carvana may struggle to achieve the growth it anticipates. Investors will be closely monitoring these economic indicators as they assess the company’s future performance.

The short-seller’s remarks serve as a stark reminder of the challenges Carvana faces as it attempts to navigate a complex and rapidly changing market. While the company has laid out an ambitious plan for recovery, the skepticism surrounding its prospects highlights the uncertainty that permeates the used car industry. As Carvana continues to grapple with its financial challenges, the coming months will be critical in determining whether it can turn its vision for 2024 into a reality or if it will continue to face headwinds that threaten its sustainability.

In conclusion, Carvana’s recent stock decline, fueled by critical comments from a prominent short-seller, underscores the challenges the company faces as it seeks to achieve a turnaround in 2024. With rising debt levels, increased competition, and a volatile economic landscape, the path to recovery may be fraught with obstacles. Investors will need to carefully consider these factors as they evaluate Carvana’s future in the used car market.