The automotive industry is experiencing a major upheaval that has seen one of its significant components, auto parts manufacturing, face unprecedented challenges, ultimately resulting in bankruptcy for one notable supplier. The cause of this financial turmoil can be traced back to the ongoing trade tensions, marked by escalating tariffs imposed on various imports. The conflict has resulted in dire consequences not only for the manufacturers involved but for the broader automotive supply chain, leading to a series of financial stresses that could reshape the industry as a whole. This recent situation serves as a critical indicator of how external economic policies can lead to immediate industry ramifications.

As tariffs were enacted, auto parts manufacturers found themselves in a precarious position. The increased costs associated with imported materials and components directly impacted their ability to operate efficiently and competitively. The recent bankruptcy filing of a major auto parts supplier exemplifies this trend, as the company struggled to absorb the financial burden associated with these tariffs. This unfortunate development not only represents the collapse of a business but also underscores the vulnerability of the automotive supply chain in the face of shifting trade dynamics.

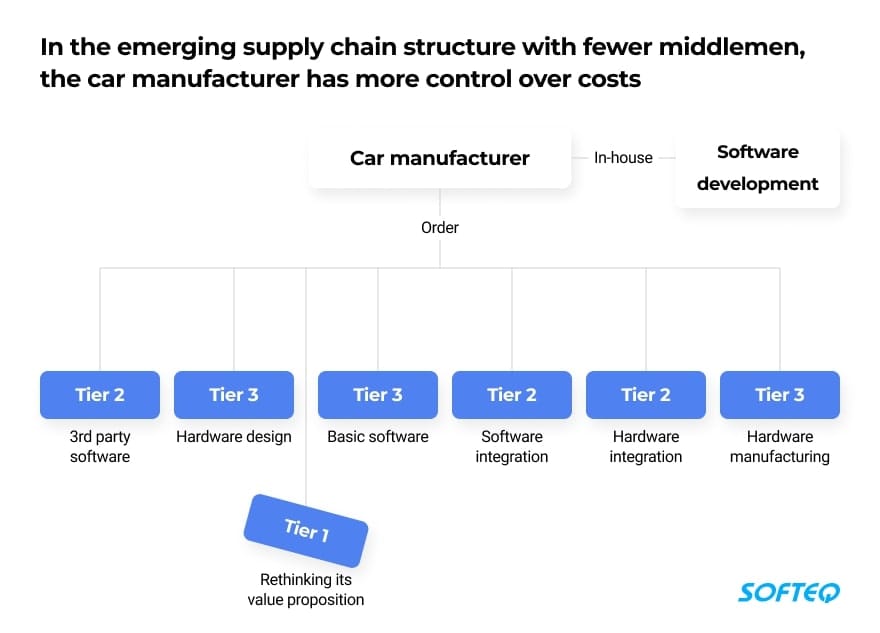

Analyzing the backdrop of the automotive industry provides insights into why such bankruptcies may become more prevalent. Automakers depend on a vast network of suppliers, each one critical to the assembly and successful market release of vehicles. A functioning supply chain relies on the timely and cost-effective delivery of parts, ranging from engines to electronic components. However, as tariffs on steel, aluminum, and other essential materials have increased, suppliers have encountered significant hurdles in maintaining their profit margins.

The impacts of these tariffs have extended beyond the immediate financial consequences faced by companies. Increased costs often trickle down to consumers, leading to higher vehicle prices. Automakers may pass these additional expenses on in the form of elevated retail prices, making cars less accessible to the average consumer. As the implications of higher tariffs are felt, some analysts warn that this could lead to decreased auto sales, which may prompt further cost-cutting measures by manufacturers.

The bankruptcy of an auto parts manufacturer does not stand alone. Economic experts suggest this could be just the beginning of a larger trend. Many smaller suppliers that lack the financial reserves and leverage to absorb rising costs may find themselves in a precarious financial position. This brings up the larger question of survival within the industry and what the future holds. Should several suppliers fail, the effects may resonate throughout the supply chain, leading to production delays and shortages in vehicle inventory across the market.

The situation also raises concerns regarding employment. As auto parts companies struggle with their finances, employee layoffs may become an unfortunate reality. The potential job losses are a grave concern not only for the affected individuals and families but also for regional economies that heavily rely on the automotive industry for sustainable growth. Cities and towns that serve as hubs for production may see a direct negative impact on their economic health if these job cuts materialize.

While the focus has largely centered on the auto parts sector, the ramifications of the tariff war extend to the automakers themselves. Some manufacturers are reassessing their production strategies, and there are ongoing discussions about relocating facilities or adjusting supply channels to mitigate tariff impacts. This re-evaluation indicates a potentially transformative shift in how automotive businesses operate, as they seek to navigate the complexities imposed by ongoing trade disputes. Future investment decisions may hinge on better forecasting of trade policy outcomes and their associated economic ramifications.

In addressing these new developments, stakeholders within the automotive industry are calling for a resolution to the tariff disputes. Industry groups are advocating for more favorable trade terms to avoid further disruptions that could result in an increasingly fragile supply chain. Policymakers are urged to consider the broader implications of trade tensions on domestic manufacturing and employment. Cooperation between government and industry seems paramount to ensuring a stable economic environment for automotive players moving forward.

As the stakes grow higher, the automotive sector is under immense pressure to adapt and thrive amid a dynamic trade landscape. The early signals of fallout from tariff disputes, such as the bankruptcy of an auto parts supplier, pose significant questions about the industry’s resilience. Ultimately, ongoing scrutiny and proactive measures will be vital to navigate these challenges successfully. In this context, the automotive supply chain stands at a crossroad, and its path forward may very well depend on the collaborative efforts of industry leaders and governmental authorities.