The past few years have been marked by significant market fluctuations, leaving investors searching for stable and reliable investment opportunities. Amidst this uncertainty, dividend stocks have emerged as a beacon of hope for those seeking consistent returns. As we approach 2025, analysts are predicting a strong showing for dividend stocks, driven by a combination of factors that are expected to make them an attractive option for investors.

One of the primary drivers of the expected resurgence in dividend stocks is the stabilization of interest rates. After a prolonged period of rate hikes, the Federal Reserve has indicated a more cautious approach to monetary policy, which is expected to lead to a period of stable interest rates. This stability is likely to make dividend-paying stocks more attractive to investors, as they will be able to generate returns that are comparable to, or even exceed, those offered by bonds and other fixed-income securities.

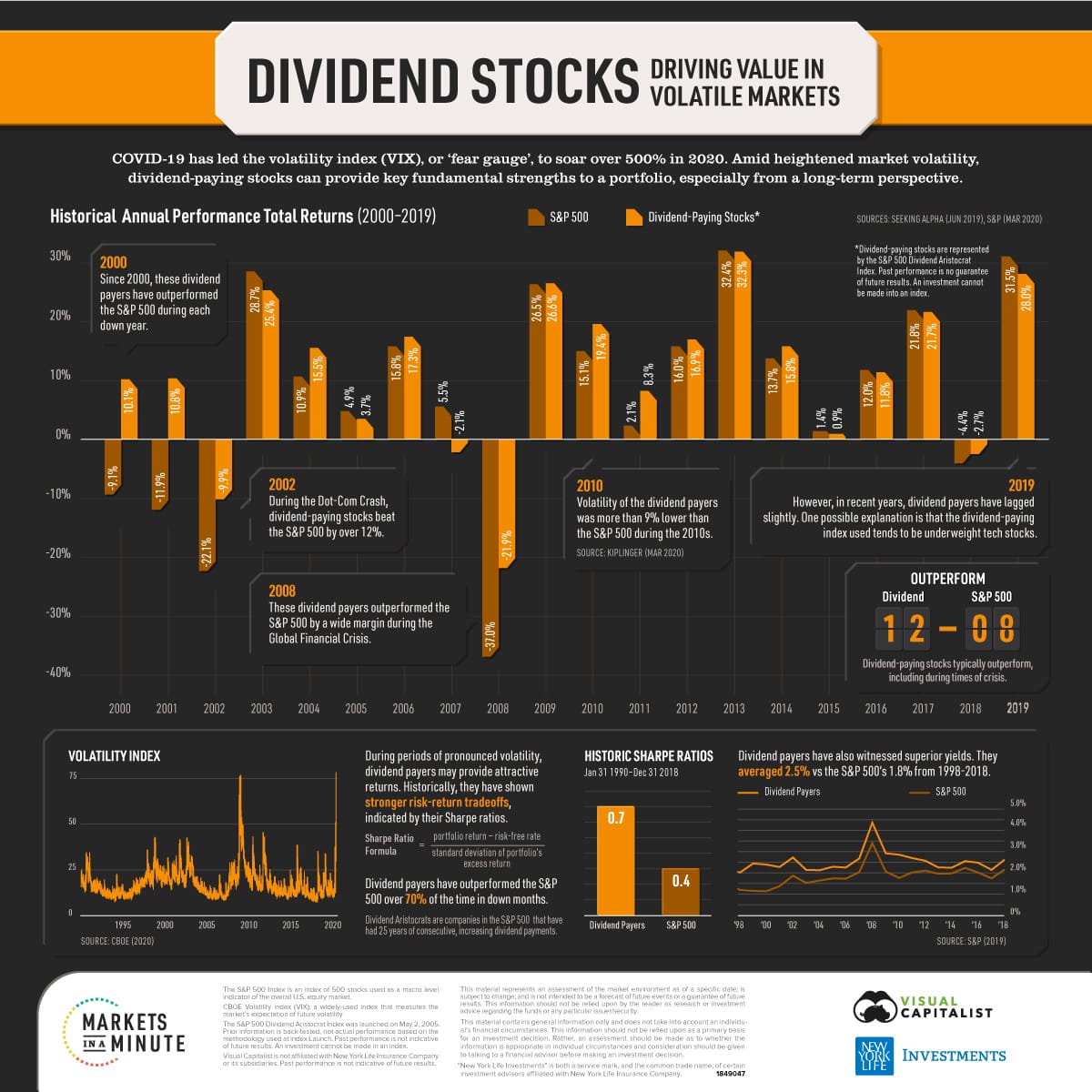

Another factor contributing to the expected revival of dividend stocks is the decrease in market volatility. The past few years have been marked by significant market fluctuations, which have made it challenging for investors to navigate the landscape. However, with the global economy showing signs of stabilization, market volatility is decreasing, making it easier for investors to make informed decisions. This decrease in volatility is expected to lead to increased investor confidence, which will, in turn, drive demand for dividend stocks.

In addition to these macroeconomic factors, there are also company-specific reasons why dividend stocks are expected to perform well in 2025. Many companies have been working to strengthen their balance sheets and improve their financial health, which has enabled them to increase their dividend payouts. This trend is expected to continue, with many companies likely to announce dividend hikes in the coming year.

The expected resurgence in dividend stocks is also being driven by demographic factors. As the baby boomer generation continues to retire, there is a growing need for income-generating investments that can provide a stable source of returns. Dividend stocks are well-positioned to meet this need, as they offer a regular stream of income that can help support retirees’ living expenses.

From a sectoral perspective, there are several areas that are expected to perform well in 2025. The energy sector, for example, is likely to be a major beneficiary of the expected resurgence in dividend stocks. Many energy companies have been working to strengthen their balance sheets and improve their financial health, which has enabled them to increase their dividend payouts. The real estate sector is another area that is expected to perform well, as many real estate investment trusts (REITs) offer attractive dividend yields.

In terms of specific stocks, there are several companies that are expected to be major beneficiaries of the expected resurgence in dividend stocks. ExxonMobil, for example, is one of the largest dividend payers in the S&P 500 and has a long history of paying consistent dividends. Johnson & Johnson is another company that is expected to perform well, as it has a strong track record of paying dividends and has a diverse portfolio of pharmaceutical and medical device businesses.

From a technical perspective, there are several indicators that suggest dividend stocks are poised for a strong showing in 2025. The dividend yield, for example, is currently above its historical average, which suggests that dividend stocks are undervalued. Additionally, the price-to-earnings ratio of the S&P 500 dividend aristocrats index is currently below its historical average, which suggests that these stocks are trading at a discount to their historical valuations.

In conclusion, the expected resurgence in dividend stocks in 2025 is driven by a combination of macroeconomic, company-specific, and demographic factors. With interest rates stabilizing, market volatility decreasing, and companies strengthening their balance sheets, dividend stocks are becoming increasingly attractive to investors. As the economic landscape continues to evolve, it is likely that dividend stocks will emerge as a major beneficiary of the changing market dynamics.