Rivian Automotive, a prominent player in the electric vehicle (EV) market, recently announced a revision of its delivery guidance, attributing the decision to several external economic pressures, including the tariffs imposed during Donald Trump’s presidency and the subsequent ongoing trade conflicts. This adjustment marks a significant moment for the company, which has garnered considerable attention for its innovative EV offerings, including the R1T pickup truck and R1S SUV.

The increase in tariffs on various components essential to the production of electric vehicles has created a ripple effect throughout the automotive industry. These tariffs have not only raised production costs for Rivian but have also exacerbated existing supply chain challenges. With ongoing trade disputes making it difficult to source necessary materials at optimal prices, Rivian finds itself in a precarious situation, necessitating the downward adjustment of future delivery forecasts to ensure operational viability and customer satisfaction.

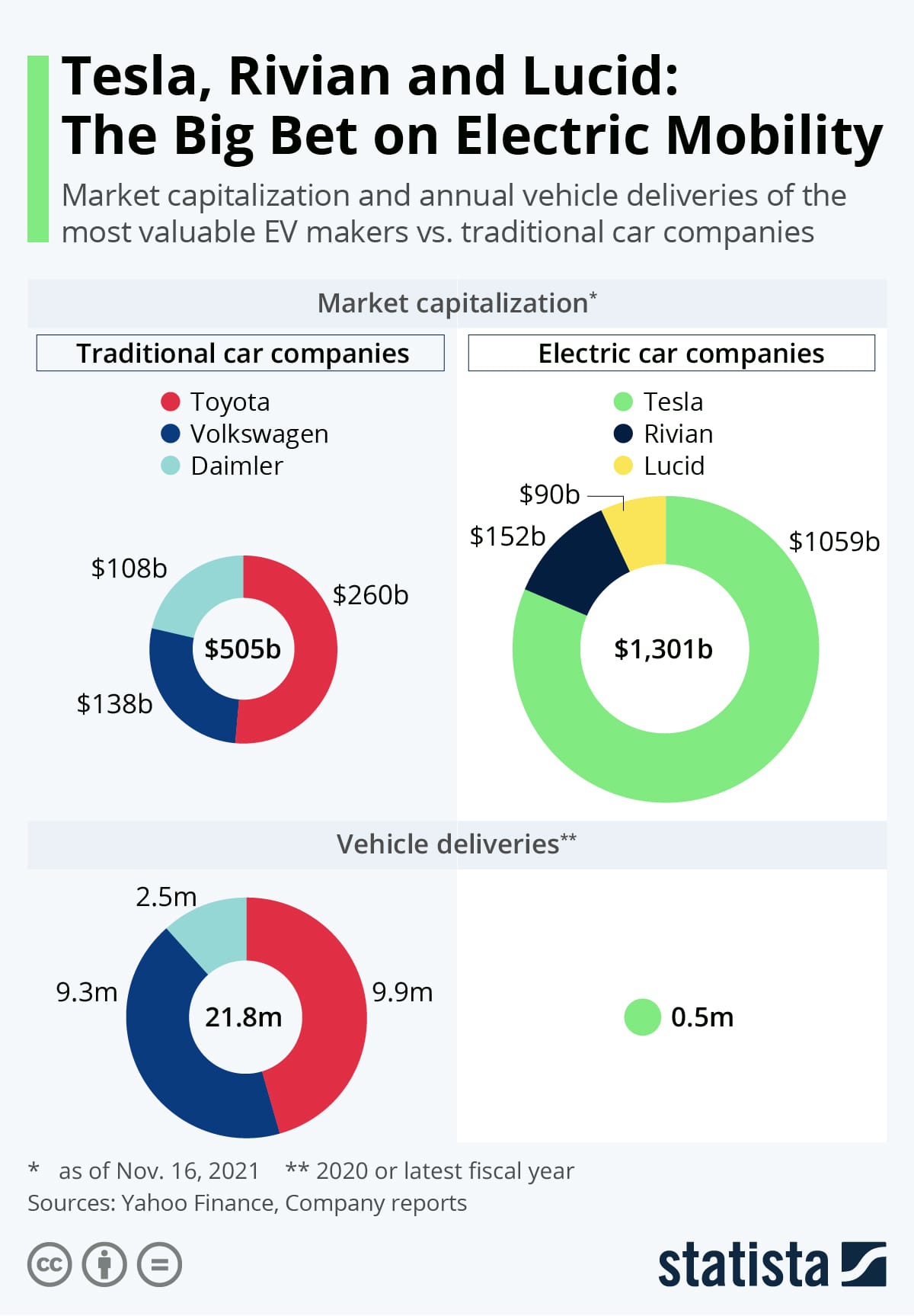

The company originally projected ambitious delivery targets in line with its mission of becoming a leading electric vehicle manufacturer, particularly as it sought to establish itself within a highly competitive market that includes industry giants like Tesla and traditional automakers pivoting towards electrification. However, the changing geopolitical landscape has forced Rivian to reassess its objectives in light of current economic realities.

Rivian’s leadership cited that while demand for its vehicles remains strong, the barriers encountered due to tariffs and trade challenges have hindered its ability to ramp up production and meet the anticipated delivery schedules. Economists have noted that the automotive sector is particularly sensitive to changes in trade policy, given the global nature of supply chains and the interconnectedness of parts production and assembly. Factors such as increased costs of raw materials, logistics restrictions, and heightened competition for components have all contributed to Rivian’s decision to recalibrate its expectations.

In light of these developments, Rivian’s management team has expressed a commitment to navigating this turbulent environment. They are focusing on optimizing their production techniques and expanding partnerships across their supply chain to mitigate the impacts of tariffs. This strategy aims to not only streamline production but also reduce costs in a bid to eventually restore their previous delivery forecasts as conditions improve.

Investors and analysts are closely monitoring Rivian’s financial performance as the company grapples with these external challenges. In its latest earnings report, Rivian indicated that it is exploring various avenues to enhance liquidity and contains costs, with a focus on research and development aimed at innovation in battery technology and manufacturing processes. The management highlighted their belief that investments in technology would ultimately pay off by improving efficiency and reducing reliance on external suppliers.

Nevertheless, the adjustment in delivery guidance is still a cause for concern among stakeholders. Rivian’s shares have experienced fluctuations in response to both the earnings announcements and the broader economic conditions surrounding EV manufacturing. Market analysts are assessing whether Rivian can maintain its competitive edge in an evolving landscape where traditional automakers are also ramping up their EV production capabilities. The demand for electric vehicles has been on a steady rise as consumers increasingly seek sustainable transportation options. However, as the industry continues to evolve, the pressures of tariffs and trade disputes could create significant roadblocks for newer entrants like Rivian.